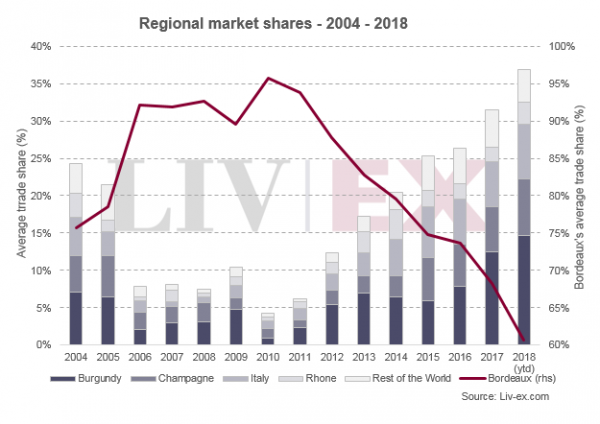

Bordeaux’s average trade share has fallen every year since 2010, Liv-ex reports. While the region is still the largest player in the market, its influence has dropped from an average of 95% share of trade in 2010, to 60.7% year-to-date – a sharp drop on last year’s share of 68.3%.

There are a number of reasons for this, including decreased interest from China, but the trend is largely propagated by a generally broadening fine wine market. In December, the platform reported that an increasing number of different wines are trading in the secondary market, pushing Bordeaux’s share back.

Instead, buyers are now looking at other areas. Burgundy’s share of trade, for example, has risen from 12.5% in 2017 to 14.7% in 2018. Last year 1,573 unique investment-grade Burgundy wines traded on the platform – up 539% on the number traded in 2010. Burgundy’s total exposure – the total value of bids and offers on the market – has grown from £3 million to £9 million in just three years.

Other regions have also seen growth, including Champagne (up to 7.6% from 6% last year), Italy (from 6% to 7.3%) and the Rhone (from 2% to 2.9%). The only category to fall, aside from Bordeaux, is the ‘Rest of the World’, which has seen a very small drop from 5% in 2017 to 4.4% in 2018. As Liv-ex notes, however, the year is not over yet, and we’ll have to wait until January to get a better handle on the final numbers.