The current market backdrop is making the case for alternative assets, such as fine wine, even stronger. Traditional financial asset classes have grown expensive and concentrated, and initiating or increasing an exposure to fine wine can provide important diversification and enhance potential returns.

It is no secret that equity valuations are stretched. The massive levels of fiscal and monetary stimulus globally have propped up asset prices despite ongoing disruption from the COVID-19 pandemic. The S&P 500 price/earnings ratio exceeded 30 in mid-April, its highest level since the 1990s dotcom bubble, which did not end well for investors. With a potential economic recovery following vaccine rollouts largely priced in, prices appear to leave limited upside in the near term.

Investors will also struggle to find attractive returns in the bond market. Even before the pandemic, yields globally were low, or even negative. Again, the downside appears to outweigh the upside as the recent selloffs in government bonds indicate. Both fixed income and equity markets remain susceptible to a shift in the economic outlook or macro policy, which should prompt investors to consider alternative ways to diversify their portfolios.

The increasing concentration of equity markets forms another reason why alternative assets make sense in the current backdrop. The sky-high equity returns of the past year have come overwhelmingly from the tech sector with the FAANG stocks - Facebook, Amazon, Apple, Netflix and Google (Alphabet) - significantly outperforming the wider market. Consequently, ETFs and other index-linked investments may not be as diverse as they might appear.

This is where fine wine can help. As a real asset, fine wine prices are primarily driven by their own market dynamics, meaning they have low correlation to traditional asset classes and can help de-link an investment portfolio from swings in the wider markets.

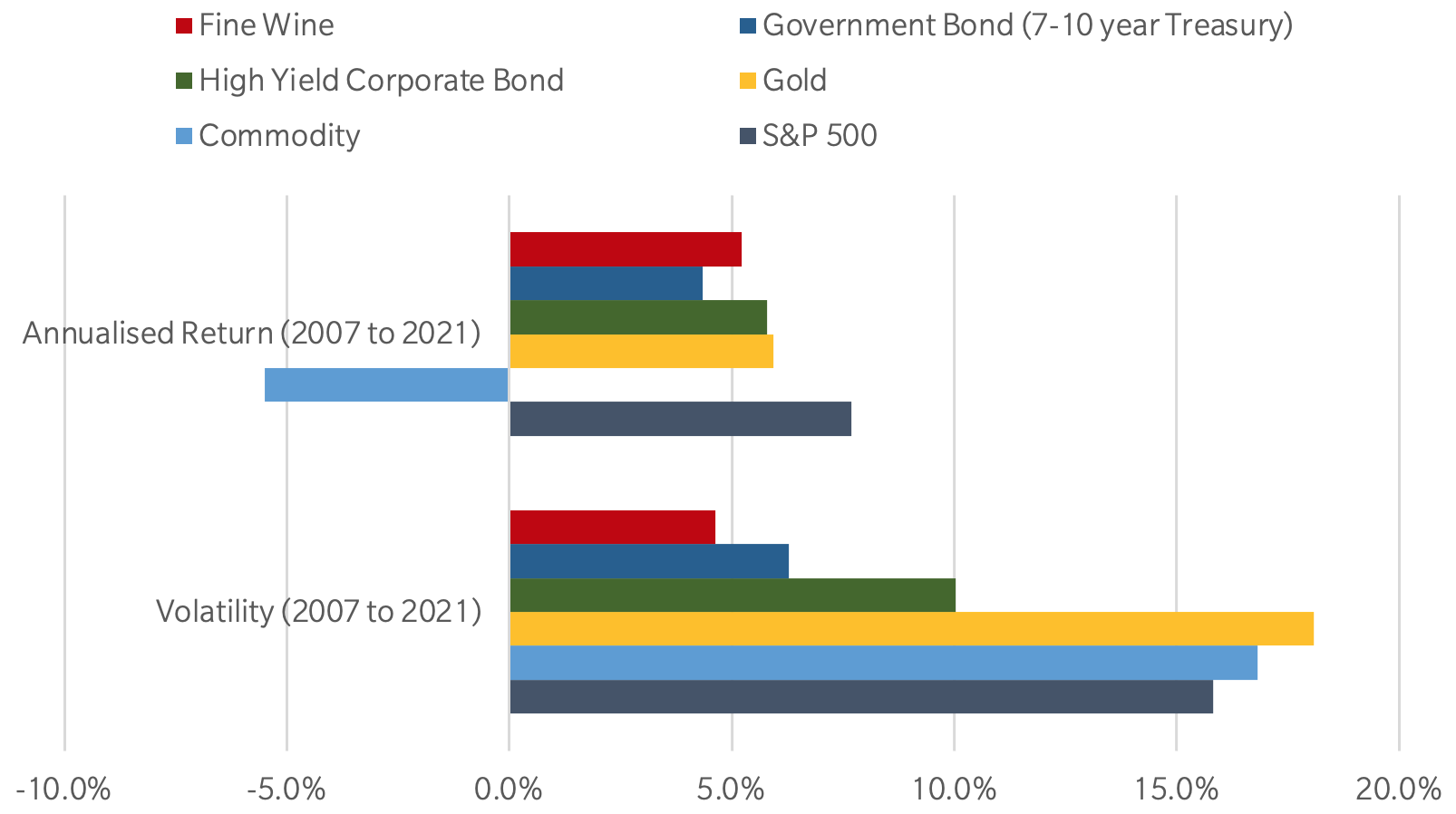

Fine wine’s limited and decreasing supply over time (as wine is consumed) alongside demand that goes beyond wine’s immediate benefit as a financial instrument can support wine prices regardless of the wider macro environment. Indeed, prior to the recent tech stock surge, fine wine often delivered better performance with significantly lower volatility over a range of backdrops going back to before the financial crisis.

Healthy returns with low volatility

Comparison of volatility and annualised return across financial assets

Unlike the concentrated equity markets, fine wine is diversifying. A main theme over the past 18 months has been the emergence of new regions and producers into the fine wine universe. The Liv-ex exchange has reported record-breaking numbers of distinct wines and producers traded in recent months while the most impressive regional growth in 2020 came from Italy, Rhone and Champagne rather than the more established Bordeaux and Burgundy. This insulates fine wine from macro policy shifts – one region’s loss can be another’s gain – and creates new growth opportunities among up-and-coming producers.

This is not to say fine wine is a sure bet in the current backdrop. The unprecedented nature of the COVID pandemic and the financial market environment means market direction in the year ahead is anyone’s guess. What we want to emphasize is that this uncertain backdrop calls for increased diversification. When it comes to investing, there is no single right answer, but we are confident a selective, research-based approach can make fine wine an attractive alternative investment.