Proven track record

The last 30 years are proof that fine wine is one of the best performing assets, with a compound annual growth rate of 10%*.

* Liv-Ex investables index 1988

Uncorrelated to the market

In times of market turmoil, such as the 2008 crisis or the coronavirus pandemic, investments in fine wine are fairly insensitive to the macro economic context.

It’s a tangible asset

Wine has intrinsic value that makes it suitable for preserving wealth as a medium to long-term investment.

Increasing demand

Globally, due to new emerging economies, people drink more fine wine than ever before. Combined with reduced supply, this makes wine prices go up.

Limited supply

Fine wine production is controlled by law. What’s more, production methods, weather conditions and geographic constraints also influence quantities. Together, these parameters contribute to the scarcity of fine wine.

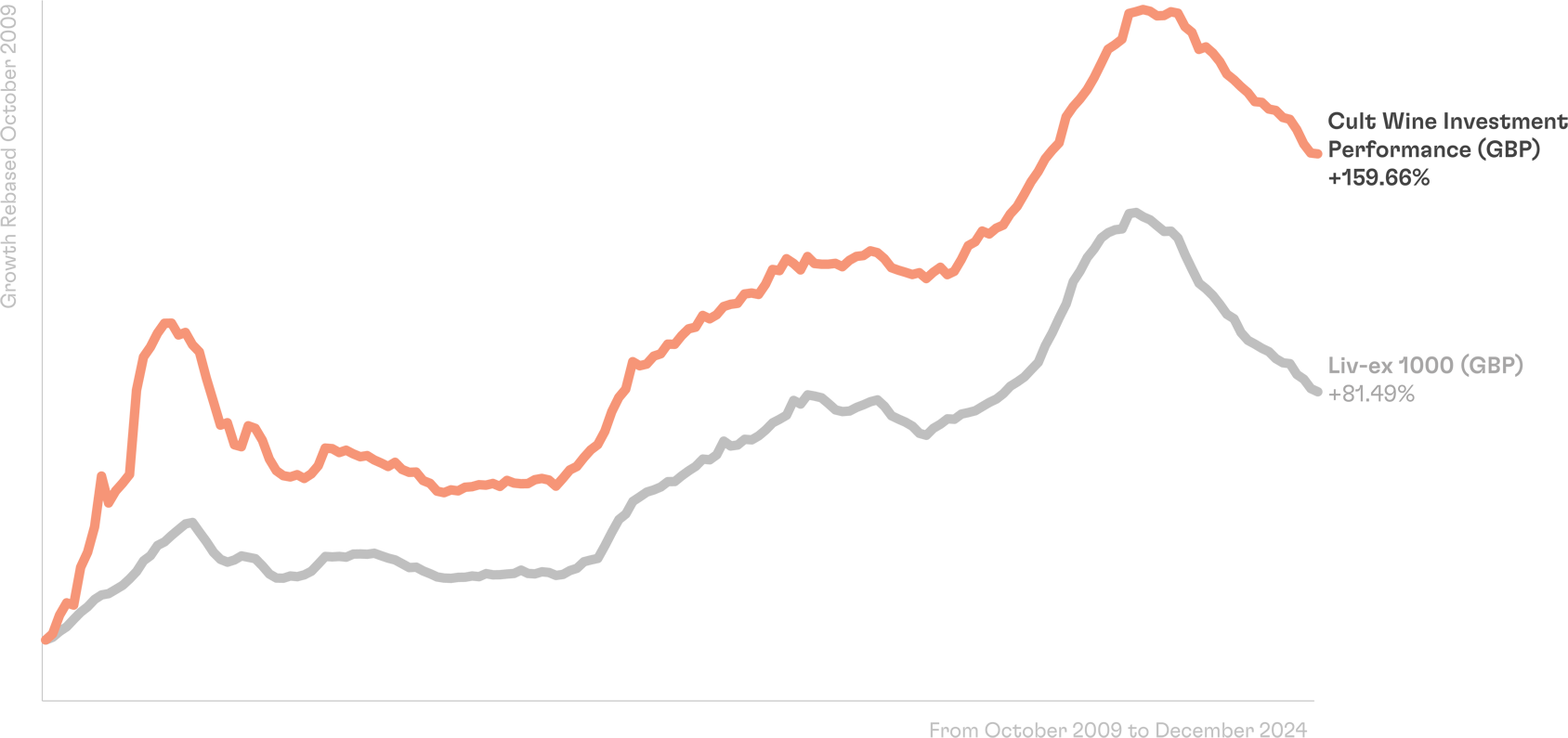

Our performance over time

Source: Pricing data from Liv-ex, Cult Wines. Analysis by Cult Wines.

Since its inception in October 2009, the Cult Wine Investment Performance has been +159.66% (+6.49% CAGR) and -2.97% in Q4 2024. The Cult Wine Investment Performance tracks the overall performance of our assets under management. Each component unit is rebased on entry at the purchase price and valued each month based on the Liv-ex market price at the end of each month.

The Liv-ex Fine Wine 1000 contains 1000 wines from the latest ten vintages, representing wine regions worldwide. Bordeaux (540), Burgundy (150), Champagne (50), Rhone (100), Italy (100) and the rest of the world (60).

What drives fine wine performance?

1 Finite supply

Every vintage is limited to a certain number of bottles due to geographical constraints, weather conditions and production methods.

2 Global consumption

Wine is consumed on a growing worldwide scale. This makes it grow scarce.

3 Increasing desirability

The more people drink wine, the rarer it gets, and the more desirable fine wine becomes.

4 Quality improves with time

When stored properly, wine appreciates with age. This makes it great for medium to long-term investment.

5 Wine critic scores

Wine scores, as determined by expert wine critics, can influence the market perception of wine.

Data-driven investment

To reach our investment goals, we identify wines with the best relative value and growth prospects. We do that by using proprietary AI-driven statistical models derived from millions of data points.

Wine. The Experience.

Fine wine is more than an alternative investment. It’s an experience that will enrich your life.