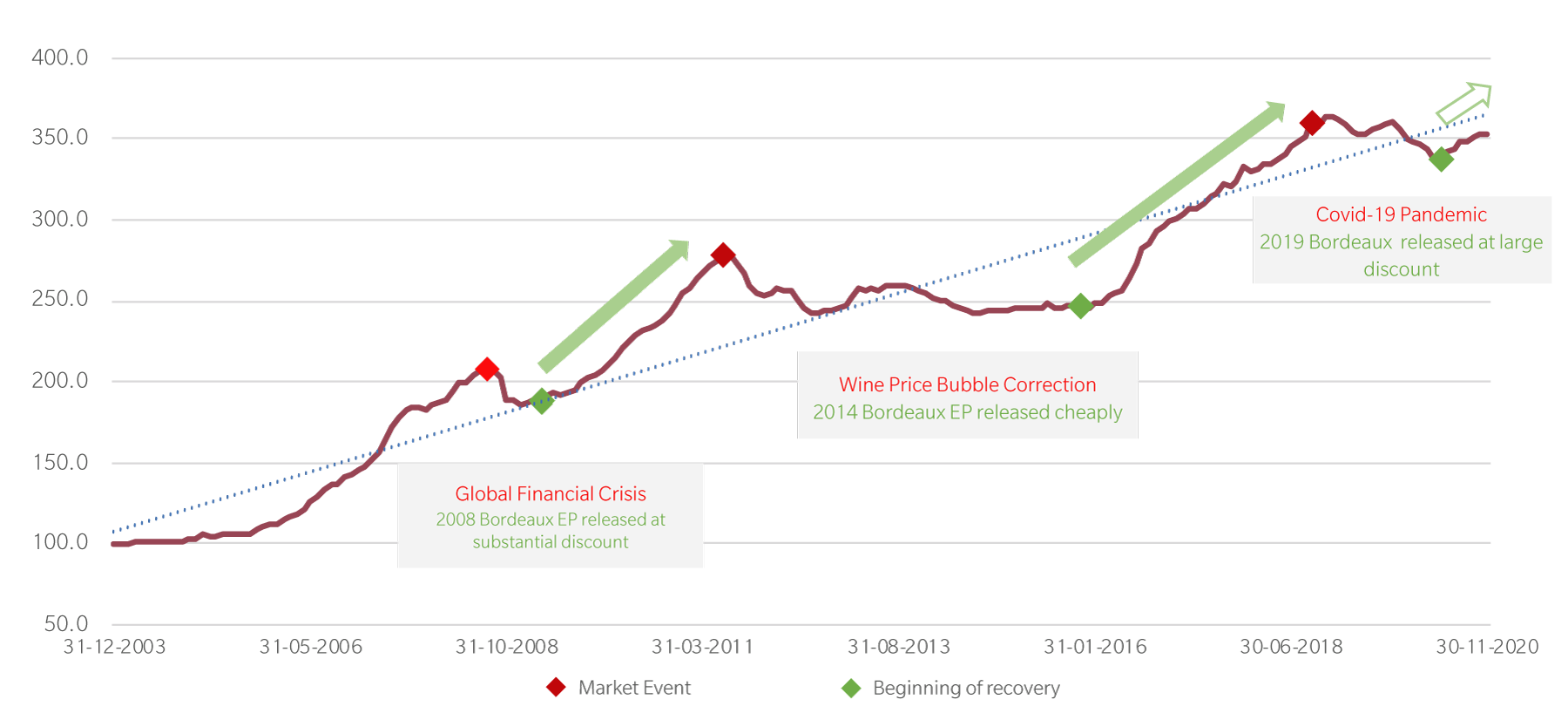

Fine wine investments are on firm footing as we head into 2021. Our favourable outlook rests on fine wine’s stable track record and growing geographic diversity. After posting a positive return in 2020 amid a range of macro challenges, we think fine wine can build on its recent performance as its long-term growth rate suggests the market still has room to improve.

Fine Wine has Room to Grow

Liv-ex 1000 Rebased at 100, Dec 2003

Data source: Liv-ex as of 30 Nov 2020

2020 Overview

The past year underscored that fine wine is a resilient investment. Despite challenges from the pandemic and global trade disputes, fine wine managed a favourable return while displaying low volatility relative to most financial markets. Champagne and Italian wines stood out as the top performers. The development of these regions and other global wine regions added to the market’s diversity, helping investors find opportunities for continued performance through the shifting backdrop.

At the beginning of 2020, we anticipated a rebound which was delayed due to the many disruptions early in the year. But now the emerging recovery in the second half of 2020 could continue and potentially gain pace in the new year. However, many uncertainties remain, and we believe investors should take a selective, analytical approach to uncover the best wine opportunities over the year ahead.

The performance of fine wine will depend on the following key themes

Covid

Fine wine would benefit if COVID vaccines help the hospitality sector normalise. But can fine wine remain stable if the economy continues to suffer?

Brexit

Brexit creates additional obstacles for the wine industry, but the greatest impact could come from the value of the British pound. Would a weak pound have a positive or negative effect on fine wine prices?

Tariffs

US tariffs hurt certain segments of fine wine in 2020 but Joe Biden’s election could mean Bordeaux en primeur enjoys a boost in US interest this year.

Region |

2020 Return* |

2021 Outlook** |

Key Drivers |

|

Bordeaux |

2.9% |

|

|

|

-1.2% |

|

|

|

|

Champagne |

8.3% |

|

|

|

Rhone |

3.6% |

|

|

|

Italy |

6.7% |

|

|

|

Emerging Markets/Rest of World |

-3.9% |

|

|

|

US |

-1.5% |

|

|

*Liv-Ex indicies as of 30 Nov

**Arrows indicate regional outlook relative to wider fine wine market performance

Region |

2020 Return* |

2021 Outlook** |

Key Drivers |

|

Bordeaux |

3.1% |

|

|

|

Burgundy |

8.5% |

|

|

|

Champagne |

9.1% |

|

|

|

Rhone |

10.8% |

|

|

|

Italy |

6.8% |

|

|

|

Emerging Markets/Rest of World |

17.9% |

|

|

|

US |

6.8% |

|

|

*Liv-Ex indicies as of 30 Nov

**Arrows indicate regional outlook relative to wider fine wine market performance

Region |

2020 Return* |

2021 Outlook** |

Key Drivers |

|

Bordeaux |

3.1% |

|

|

|

Burgundy |

8.5% |

|

|

|

Champagne |

9.1% |

|

|

|

Rhone |

10.8% |

|

|

|

Italy |

6.8% |

|

|

|

Emerging Markets/Rest of World |

17.9% |

|

|

|

US |

6.8% |

|

|

*Liv-Ex indicies as of 30 Nov

**Arrows indicate regional outlook relative to wider fine wine market performance