Evaluating the Investment Performance of Fine Wine: Returns and Opportunities

Importance of Understanding Investment Performance

Why Do People Invest in Fine Wine?

Introduction to Major Wine Indices

The Current Market Downturn and Long-Term Outlook

Historical Patterns of Market Recoveries in the Fine Wine Market

The fine wine market represents around 1-2% of the $450 billion global wine market. Wines considered fine must meet strict criteria of quality (highly regarded by critics), longevity (able to age for 10-20 years), and price point (above $50 per bottle). Fine wines are also those collectible enough to be regularly traded on the secondary market, such as at auctions, where demand often outstrips supply.

Wine Investment has evolved over the past three decades, transitioning from a hobbyist pursuit to a serious alternative asset class. Both retail and sophisticated investors now seek wine for its uncorrelated returns. Understanding market dynamics when making purchase or sale decisions is crucial for collectors and investors.

Importance of Understanding Investment Performance

As more capital flows into the fine wine market, it’s essential for investors to assess market performance. This includes evaluating returns by region, wine type, and producer. Reliable, current data on wine performance is crucial for informed investment decisions.

The purpose of the article is to evaluate how wine is performing as an investment in 2024. Whether wine is a good investment, the returns you can expect from investing in wine and whether now is a good time to invest in wine.

Definition and History of Wine Investment

Wine investment as an asset class has significantly evolved over the past two decades. Before 2000, only those "in the know" engaged in wine investment, often accumulating extensive collections that increased in value over time. Collectors and enthusiasts would amass much larger collections than they could ever drink, knowing that their collections would provide value over many years, both through drinking mature wines and reselling them for a profit. These sales could provide a lucrative windfall or help fund future purchases.

In the post-2000 internet age, the wine market became more transparent and efficient, reducing its opacity. This allowed a wider audience to realise the significant returns that could be made by investing in wine. As the internet evolved and made information more accessible, wine as an asset class became within reach of a much larger audience.

The past 15 years have marked a surge of interest and development in wine as an investment, driven by the record-low interest rate environment. Post-global financial crisis, with near-zero interest rates, cash paid almost nothing. This situation led investors and savers worldwide to seek alternative sources of return. As interest in alternative assets increased, wine, along with art, watches, and collectibles, became increasingly sought after.

Why Do People Invest in Fine Wine?

The monetary conditions faced by investors pushed them to look beyond the traditional 60/40 portfolio. As more people entered the wine market for investment, it became clear that wine could deliver more than just financial returns. For those with disposable income and an interest in wine, investing offered an engaging way to explore and learn about a product they were passionate about while making a profit. Furthermore, due to the unique characteristics of wine, it provided uncorrelated returns, offering a way to balance risk in traditional assets.

A generational shift has recently shown younger investors' larger appetite for non-traditional assets. Large investment managers like BlackRock have declared that the traditional 60/40 blend of equities and bonds is over. Investors now need exposure to alternative assets to achieve better risk-adjusted returns. This momentum has been met by a changing demographic of high-net-worth individuals eager to invest in more esoteric areas, especially those that deliver beyond just financial returns.

In summary, wine appeals to investors because of its long track record of financial returns, inherent lack of correlation to financial markets, and ability to provide unique experiences. It engages both new and older generations as a fascinating product full of rich history and learning opportunities.

Key Factors Influencing Wine Prices

Wine values have never increased in a purely linear fashion. Generally, fine wine increases in value over time due to the supply-demand imbalance, which intensifies as bottles are consumed and supply decreases. Simultaneously, the remaining bottles improve and mature, becoming more desirable to drink. This two-step interaction typically results in a steady increase in value for fine wines.

An academic paper titled "The Price of Wine," published in the Journal of Financial Economics in 2015, noted that between 1900 and 2012, fine wine provided an average annual return of 4.1% in real terms (i.e. above inflation), outperforming other alternative investments like art and stamps. Historically, fine wine has shown minimal correlation with traditional assets, making it an effective tool for portfolio diversification. During economic downturns, when equities may falter, fine wine often demonstrates remarkable resilience.

The underlying dynamics of supply and demand drive the long-term value of fine wine. However, prices do not necessarily evolve in a linear fashion, and not all wines deliver consistent returns. Numerous factors can influence the price of wine, but some fundamentals have an outsized impact. These include the perceived and established quality, often determined by professional wine critics and increasingly by crowd-sourced reviews on community platforms.

Other critical factors include:

- Liquidity or secondary market demand

- Volume of production

- The age of the wine

For example, consider a bottle of wine from a renowned producer in an established region that generates significant secondary market activity. If this wine is mature, optimal for drinking, and has been on the market for 20-30 years, it could command a high price, especially if only a few thousand bottles were initially produced. This price could be significantly higher than a newly released wine from the same producer, which requires another ten years to be ready to drink and another ten to reach its optimal state.

Market trends and cycles also play a crucial role in wine pricing. The impact of recent events, such as the COVID-19 pandemic and the subsequent tightening of global monetary supply and interest rate increases, has been evident in the wine market. Analysing wine index performance reveals the market's cyclical nature, with some regions being more affected than others. This underscores the importance of a diversified approach within a wine investment portfolio to navigate market cycles effectively and reduce overall risk.

Introduction to Major Wine Indices

The most widely recognised wine indices are provided by Liv-ex, the fine wine exchange. The Liv-ex 100, comprised of 100 top wines, serves as a benchmark and is reviewed annually. The Liv-ex 1000 offers a broader view by tracking 1,000 wines from key regions such as Bordeaux, Burgundy, Italy, and Champagne. The Liv-ex Investables Index provides data on certain wines dating back to the late 1980s, which is useful for long-term analysis but is limited to wines only from Bordeaux.

Overview of the Performance of These Indices Over Different Time Periods

Historical analysis shows that both the Liv-ex 100 and Liv-ex 1000 have delivered strong returns, often outperforming traditional assets. Over the past decade, the Liv-ex 100 has shown steady growth, while the Liv-ex 1000 has demonstrated robust performance, highlighting the market’s strength and diversity. By examining these indices over 5, 10, and 20-year periods, investors can identify patterns and make informed decisions about future gains.

As of July 2024, the Liv-ex Investables Index has shown a return of 2,050% since 1988, the Liv-ex 100 has grown by 272.5%, and the Liv-ex 1000 by 288.3% since January 2004.

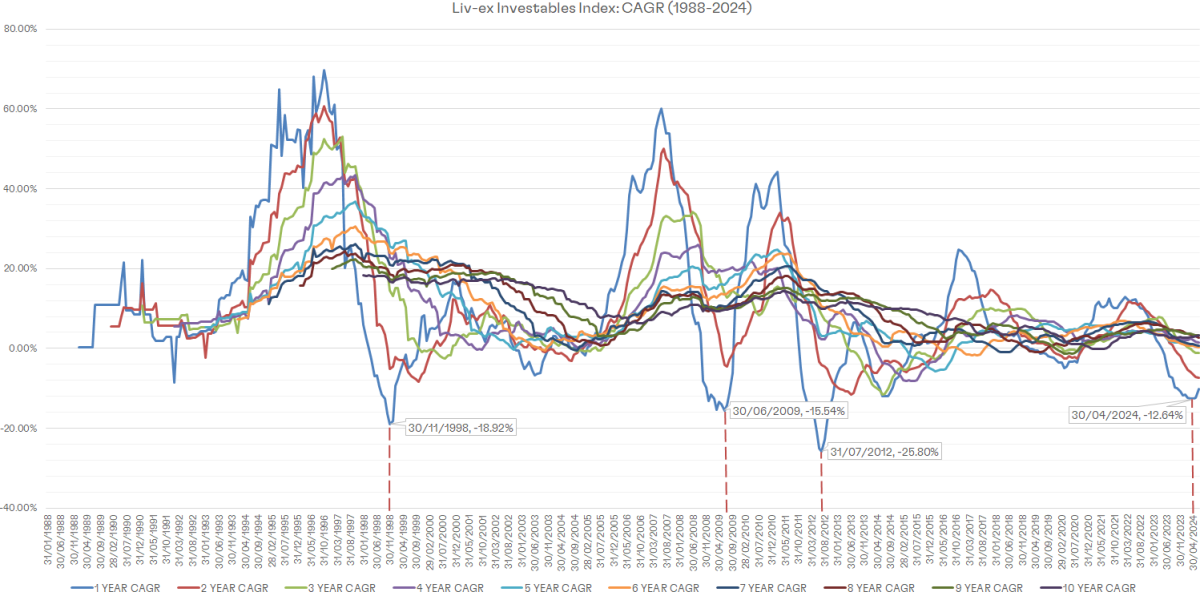

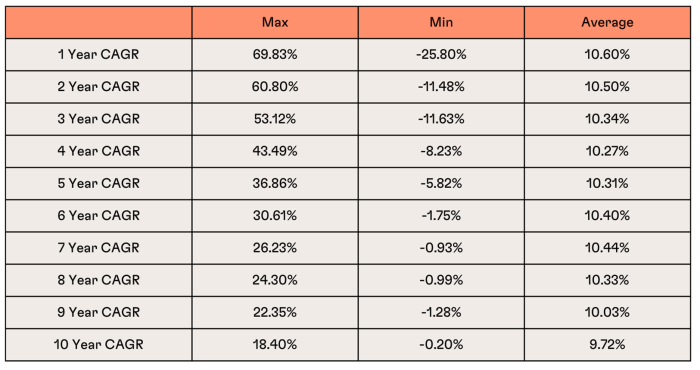

- Compounded Annual Returns Analysis: To calculate the Compounded Annual Growth Rate (CAGR) for the wine indices, we used monthly index returns over various periods, ranging from 1 to 10 years.

- Rolling Periods: We calculated the CAGR over rolling periods, computing the CAGR for 1-year, 3-year, 5-year, and up to 10-year periods for each month in the dataset.

Analysing the CAGR of the Liv-ex Investables Index

This analysis indicates that longer investment periods reduce volatility and enhance consistency. For example, the 10-year CAGR shows only one period with a negative return, highlighting wine investment’s long-term potential and stability.

Fine Wine Investment Guide 2025

Download your guide to fine wine investing and discover how this unique, tangible, and tax-efficient asset can enhance portfolio diversification. Gain valuable knowledge and insights with this indispensable document for investors.

The Current Market Downturn and Long-Term Outlook

Given the market downturn over the past 12-18 months, where the Liv-ex 1000 has dropped 17.7%, the obvious question is where the market is heading and whether now is a good time to invest in wine.

Investing in fine wine, like any market, is significantly influenced by investor psychology. When prices rise, there is often a surge of enthusiasm, and many investors jump in, driven by hype and the fear of missing out. Conversely, during downturns, the instinct is to exit quickly, driven by fear and uncertainty. This hesitation to buy back in, even when the market offers great value, is common. However, history has shown that these periods of market dips are often the most advantageous times to invest as long as the long-term fundamentals remain strong. Savvy investors who recognise this psychological pattern can capitalise on these opportunities, buying at lower prices and benefiting from future market recoveries.

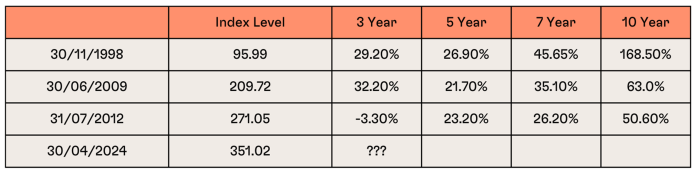

As illustrated in the graph, we have depicted the last four market downturns by the point in time when the 1-year CAGR hit its lowest point. The table below shows the market returns if an investor had entered the market at these market lows.

The key takeaway here is that out of the 12 periods we examined, 11 out of 12 generated a positive return. This suggests that entering the market after a downturn reduces overall risk for wine investors.

While it is undeniably challenging to time any market, the data from the Liv-ex Investables Index shows several insights for investors:

- When investing in wine, you should consider a minimum of 5 years. The longer you invest, the more consistent and stable the realised returns become.

- The previous three market downturns have proven to be opportune times to enter the market, with only one out of 12 periods generating a negative return.

- If you can’t time a market but believe in the fundamentals underpinning fine wine appreciation, then investing after a market correction gives a wine investor an increased opportunity for returns.

One downside of analysing this dataset is that the index comprises a narrow set of wines, exclusively mature Bordeaux. While this provides a relatively good view of returns from investing in wine, it is narrow and focused solely on the Bordeaux market. As the market has evolved, Bordeaux, while integral and key, has become a smaller proportion of the overall market. Regions such as Burgundy, Champagne, Tuscany, Piedmont, Rhône, Napa, and the rest of the world are increasingly important.

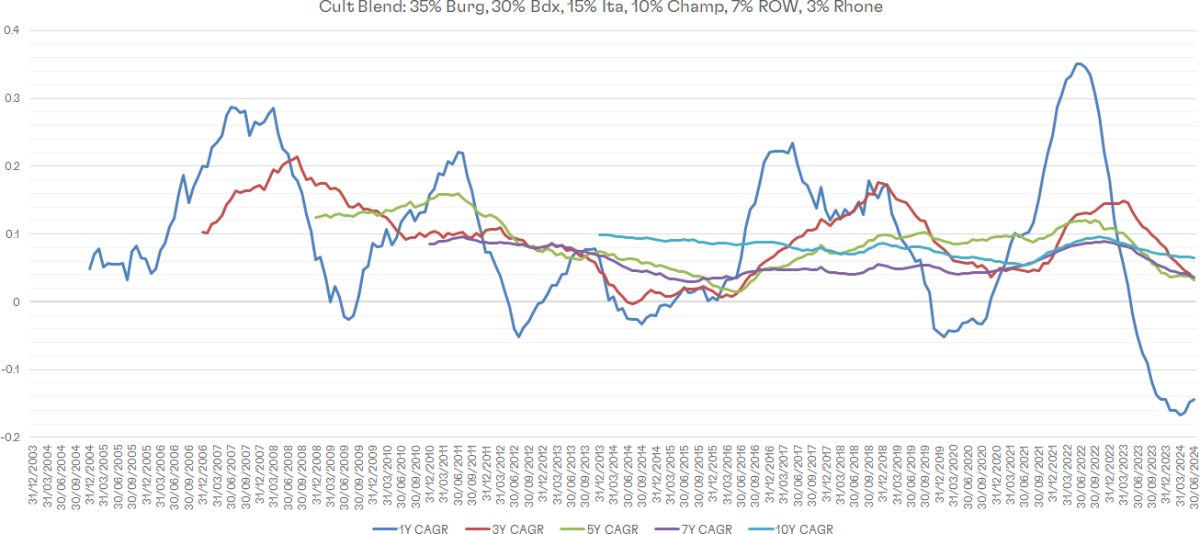

To better evaluate the performance of a market representative of the overall regional composition, we use data from more recent indices covering the last twenty years (2004-2024). The Liv-ex 100, while being the benchmark, is still overly focused on Bordeaux. To build a better representative view, we have used the regional indices that make up the Liv-ex 1000 and applied a proportional split representing our view of the market: 35% Burgundy, 30% Bordeaux, 15% Italy, 10% Champagne, 7% Rest of the World, and 3% Rhône.

Analysing the CAGR of the Blended Index

Analysis of Blended Wine Investment Returns

One of the first things that stands out is the increased volatility shown by the higher peaks and troughs of the 1-Year CAGR line. This highlights the extreme market conditions experienced over the past 3-4 years, from the start of the pandemic to now, including a +20% growth in 2022 and an almost -17% drop in the subsequent 18 months.

In contrast to the Liv-ex Investables Index, which focuses exclusively on Bordeaux, this blended index has only a 30% exposure to Bordeaux. As a result, we can see a more consistent return profile across the time periods studied.

Fine Wine Investment Returns Over Short, Medium and Long-term

An investment made into a blended regional exposure, as outlined, would have provided a positive gross return across every 5-year period studied between 2004 and 2024. On average, a wine portfolio returned 8.76% annualised returns every 5-year period during this time.

If you had invested in a portfolio with 35% in Burgundy, 30% in Bordeaux, 15% in Italy, 10% in Champagne, 7% in Rest of the World, and 3% in Rhône, and held it for five years, the best return would have been 15.94% compounded, and the worst, 1.43% compounded.

Impact of Recent Market Downturn

The wine market has experienced a challenging 18-24 months, with prices falling by 10-20%. However, there are signs that the market is stabilising, and the rate of price declines is slowing down. While there are some improvements, it is clear that the market remains soft and has not yet fully recovered.

The current interest rate environment has made alternative investments like wine less attractive. As interest rates are expected to decrease from central governments in the second half of 2024 through 2025, the wine market is anticipated to experience a resurgence and recovery.

Given this positive outlook and encouraging data on current market trends, it is useful to examine historical performance during previous market downturns. Our analysis indicates that investing in wine after a downturn can improve performance and, in some cases, reduce downside risk. This is logical, as buying into an asset class after a price correction means it is less likely to experience similar or worse price declines due to the lower starting point.

Historical Patterns of Market Recovery in the Fine Wine Market

Historical data shows that wine investment often recovers quickly and predictably after downturns. This is due to the fundamentals driving wine prices: long-term demand/supply imbalances and improving wine quality over time.

Entering the market after a downturn can be advantageous, as prices are typically lower and less likely to fall further. The data suggests that investing in wine during these periods offers increased opportunities for returns.

Wine investment has consistently delivered average annual returns of 10% since 1988. Long-term investment in fine wine results in more consistent returns and reduces the likelihood of negative periods.

Historical data shows that entering the market after a downturn offers greater downside protection and better potential for capital appreciation. Despite recent downturns, the fundamentals driving wine prices remain strong, and the market is poised for recovery.

Investors who believe in the benefits of wine as an asset class, with its uncorrelated returns and long-term track record, will find that investing now, contrary to current market sentiment, will benefit their long-term performance.