Fine Wine Market Recovery Gains Momentum with Strong Q2 Results

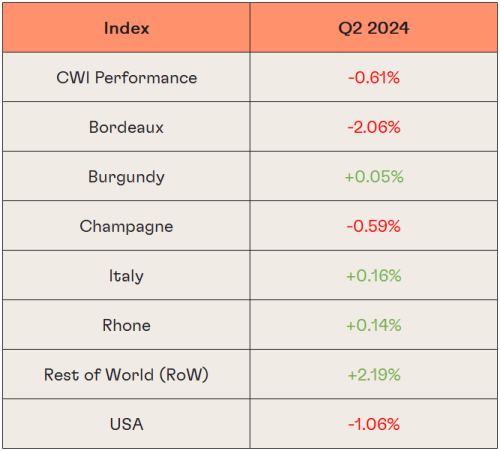

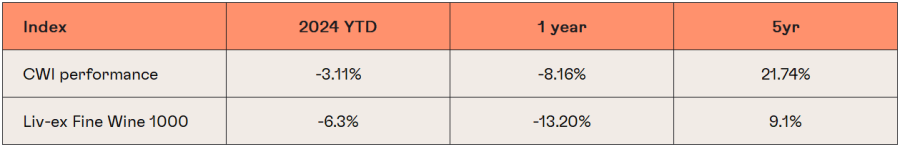

In Q2, our overall index posted a small decline of -0.61%, however, taking a closer look at the data, we can see a positive pattern emerging. Four out of our seven regional indices posted a positive return and there is a clear upward trend in the trading data.

Source: Cult Wines Performance.

Pricing data from Liv-ex as of 30 June 2024.

Rebased as of 31 March 2024.

Analysis by Cult Wine Investment.

Whilst modest, these gains in our holdings are encouraging, and our approach to portfolio management via tactical allocation and active rebalancing has enabled us to outperform the wider market.

In our Q1 note to investors, we highlighted our view that with interest rates stabilising we expected continued improvement in fine wine fundamentals to result in positive gains over the next several quarters.

As anticipated, this held true through the second quarter, when once again we saw the benefits that being invested in the right regions and the right mix of wines can have on performance despite the ongoing headwinds created by sustained higher borrowing costs and ongoing geopolitical tensions.

After the well-documented market correction throughout 2023 and the first part of 2024, we have seen prices stabilise, and this is now starting to be reflected in the leading regional indices. Wines have started to find strong support, with interesting patterns developing from trading data (see below).

Fine Wine Investment Guide 2025

Download your guide to fine wine investing and discover how this unique, tangible, and tax-efficient asset can enhance portfolio diversification. Gain valuable knowledge and insights with this indispensable document for investors.

Analysis: Dom Perignon 2008

Overview

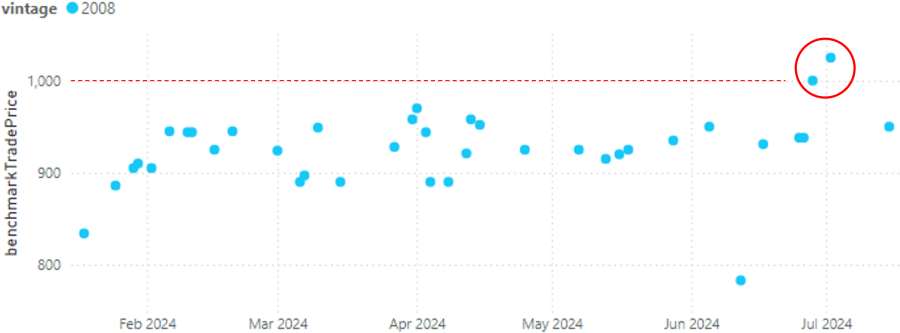

The chart below details all trades of Dom Perignon 2008 since the beginning of the year. Notably, in the past few weeks, we've observed the year's first trades exceeding £1,000 per six-bottle case. For context, the first trade in January was at £834 per six. The trade on 2nd July at £1,025 marks a 22.9% increase year-to-date.

Source: Liv-ex Trades. Prices as of 16 July 2024.

Price Evolution

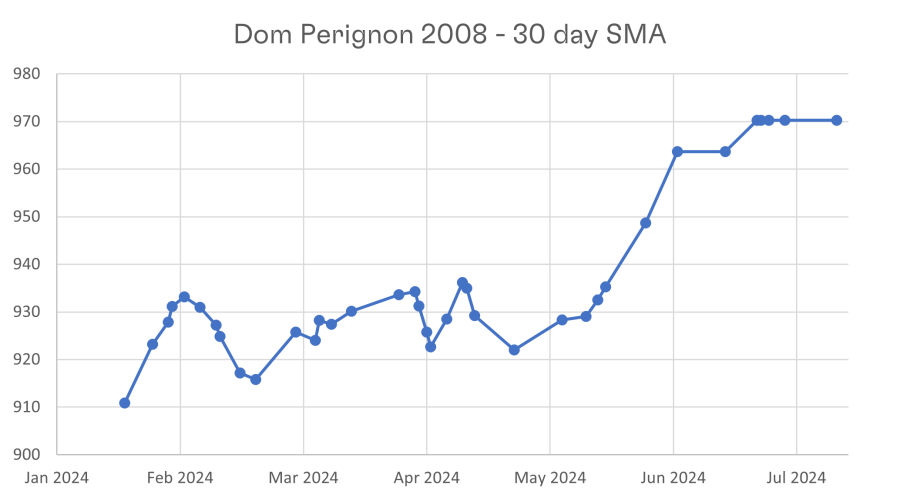

Examining the 30-day Simple Moving Average (SMA) derived from the trading data, it is evident that the price has positively evolved and is trending upwards since the start of the year.

In Q1, the price shifted from approximately £910 per six to just under £930. By the end of Q2, in June, it had advanced to £970 per six, representing a 6.6% increase since the year's start.

Source: Simple Moving Average (SMA). Liv-ex Trades. Prices as of 16 July 2024.

Trade Consistency and Recent Trends

Throughout the year, Dom Perignon 2008 has traded consistently, with 5-10 trades occurring on a rolling 30-day basis, a trend that has remained steady. The overall pricing trajectory has been positive, with the highest trade of 2024 occurring within the past fortnight, marking the first time the wine has traded above £1,000 per six since November 2023. The £1,025 trade is the highest since May 2023, a span of 14 months.

Conclusion

Dom Perignon 2008 has demonstrated a robust and upward price trend this year, coupled with consistent trading activity. The recent high trades underscore the market's confidence and demand for this vintage, highlighting its value as an investment.

Analysis: Gaja, Barbaresco 2019

Overview

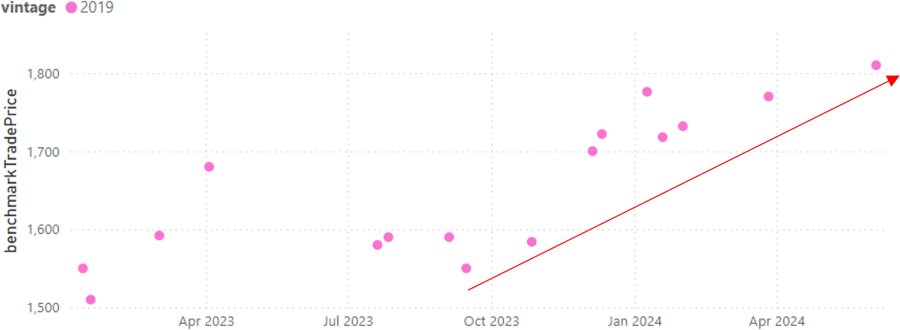

The chart below presents the trading data for the 2019 Gaja, Barbaresco. As one of the more liquid wines from Piedmont over the past year, it boasts strong secondary market trading data across numerous vintages—19 vintages have traded since the start of 2023.

This case study focuses on the 2019 vintage, which has been on an upward trend since the start of 2024.

Source: Liv-ex Trades. Prices as of 16 July 2024.

Price Trends and Record Highs

In June, the wine traded at a record high of £1,810 per 12-bottle case, marking the first time this vintage exceeded the £1,800 threshold. This price represents a 6.5% increase from the last trade price of £1,700 per 12 in 2023, following a consistent upward trend throughout 2024.

Market Stability and Regional Performance

Italy, in general, has been one of the better-performing regional sub-indices during this market downturn. This example highlights the level of stability seen in Italian wines, which have, to a certain extent, managed to buck the trend.

Extending the view to include all vintages over a longer timeframe, it is evident that this high-profile and highly liquid wine from northern Italy has delivered stability that has continued into 2024.

Source: Liv-ex Trades. Prices as of 16 July 2024.

Market Appetite and Signs of Recovery

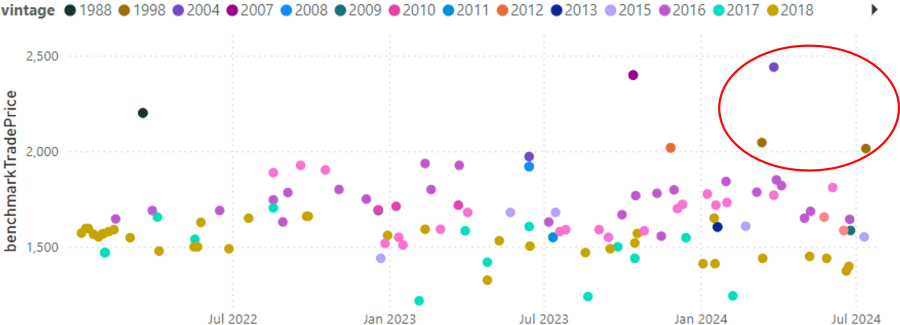

Notably, three vintages have traded above the £2,000 per 12-bottle case mark since the start of the year. This matches the number of trades above this price level in the previous two years (2022 and 2023), indicating a current market appetite for these elevated levels, which is a potentially positive sign of recovery.

Analysis: Pontet Canet 2009 & 2010

Overview

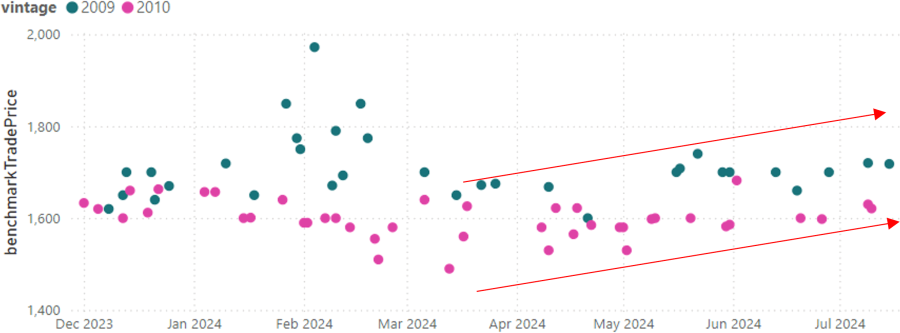

Pontet-Canet is one of the most traded wine brands in the market and undoubtedly one of the most liquid wines in Bordeaux. As such, it serves as a reliable indicator and barometer for general market trends. The graphic below illustrates the trading data for the 2009 and 2010 vintages in 2024.

Price Trends and Market Activity

Despite a burst of outlier activity in February for the 2009 vintage, the data generally shows an increase in the average traded price since the end of Q1 in March. The lowest trade of the year for the 2010 was £1,490 in March, while the most recent trade in July was £1,630, representing a 9.4% increase.

Similarly, the 2009 vintage has seen an uptick in the last three months, with nine trades recorded above £1,700 since May, averaging £1,710 per 12-bottle case. In comparison, there were six trades in March and April, averaging £1,660, indicating a roughly 3% increase in the average traded price.

Source: Liv-ex Trades. Prices as of 16 July 2024.

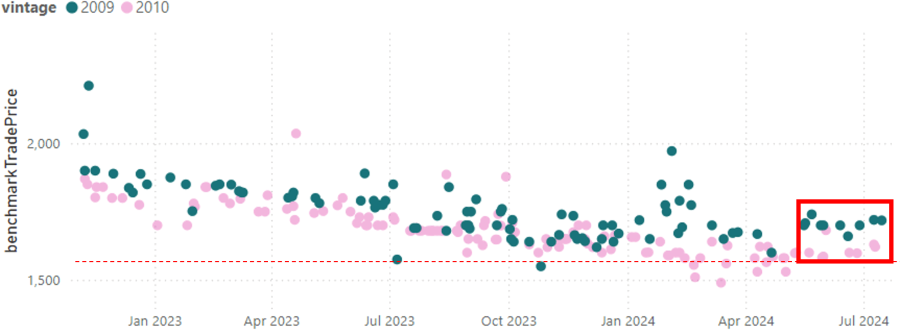

Market Stability and Long-Term Trends

While this data does not suggest a significant rally, it does indicate that prices are holding steady with small marginal gains in these highly liquid wines. When we take a longer-term view, it is worth noting that these wines were trading between £1,800 and £2,000 at the beginning of 2023. Despite the decline since then, there has been a stabilisation and recovery in trading prices from Q1 to Q2 2024. As illustrated by the dotted line in the graphic, the new support level for pricing sits comfortably above the prices at which these wines were trading in Q1. This tends to suggest that the price correction phase for this wine is over.

Source: Liv-ex Trades. Prices as of 16 July 2024.

Fine Wine Investment Guide 2025

Download your guide to fine wine investing and discover how this unique, tangible, and tax-efficient asset can enhance portfolio diversification. Gain valuable knowledge and insights with this indispensable document for investors.

Strong Opportunities Remain for Higher Returns

Meanwhile, we continued to actively deploy into both new wine releases and back vintages of household names, capitalising on indicators that the market might be bottoming out as investors take advantage across the different regions. With a focus on areas of the market that we believe are temporarily depressed and set to rebound the quickest.

Two recent examples of this include:

1) Bordeaux En Primeur 2023

As recently reported, the EP 2023 campaign was mixed despite significantly adjusted prices versus 2022. Rigorous selection and sound appraisal were key for our investment team, and we have identified 15 releases that fit our high conviction criteria.

2) Iconic Wine Strategy

Read more about our Iconic Wine Strategy here

There has never been a more opportune time to invest in the world’s most iconic wines. Over the past two years, these prestigious wines have reached their lowest price levels, influenced by a slowing global economy, higher interest rates, and subdued consumer spending.

Being active in the market today when there are few other competitors is allowing us to capture what we feel are uniquely attractive and temporarily outsized returns which have the potential to result in better performance for investors over the next several years.

Our aim is to help our investors capture a disproportionately larger share of the upside while also, hopefully, experiencing a disproportionately smaller share of the downside. (It’s important to remember that all investing comes with some periods of ups and downs).

We believe that the fine wine market is on the brink of a significant upswing. The major market indices stabilised in Q2, and economic indicators suggest that consumer confidence and spending are set to improve, which historically correlates with increased demand for assets such as fine wines.

Related Articles