Fine Wine as a Portfolio Diversifier: The Investment Case in Data

Historical Performance: How Fine Wine Compares to Equities, Bonds & Gold

Fine Wine vs. Market Crashes: A Hedge Against Volatility

Volatility & Risk-Adjusted Returns: Fine Wine Outperforms

Portfolio Optimisation: The Impact of a Fine Wine Allocation

Correlation Analysis: Fine Wine as a Portfolio Diversifier

Final Thoughts: Why 2025 Is the Right Time to Invest in Fine Wine

The case for fine wine as an alternative investment has long been based on its low correlation to traditional assets, resilience during market downturns, and strong long-term performance. Now, as investors seek to navigate an increasingly uncertain macroeconomic environment, data-driven evidence reinforces why fine wine deserves a strategic allocation in diversified portfolios.

In our previous article, we explored Goldman Sachs’ 2025 investment outlook, which highlighted diversification and alternative assets as key themes for HNW investors.

Today, we go a step further—leveraging historical data to prove that fine wine has delivered strong, risk-adjusted returns, remained uncorrelated to equities, and outperformed during key financial crises.

Historical Performance

How Fine Wine Compares to Equities, Bonds & Gold

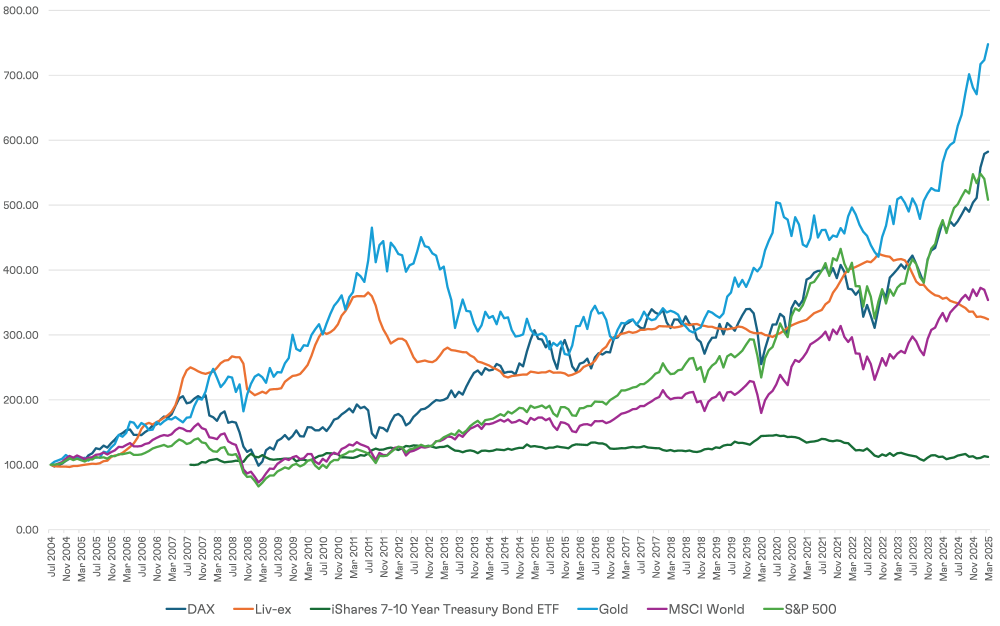

To analyse fine wine’s role as an investment asset, we compared the performance of the Liv-ex 100 (fine wine index) against traditional asset classes:

- S&P 500 (US equities)

- DAX (European equities)

- MSCI World Index (global equities)

- US Treasuries (bonds, iShares 7-10 Year ETF)

- Gold (inflation hedge & store of value)

Each index was rebased to 100 to allow for a fair comparison, spanning over two decades (2004–2025). The results were striking:

Source: Liv-ex and investing.com. July 2004 to March 2025

- Fine wine has demonstrated solid long-term returns, but it is susceptible to market cycles. At the peak of its most recent market cycle, it was briefly the best-performing asset class (summer 2022). But has since dropped off, as equity markets have rallied and fine wine has gone through a correction following central banks globally increasing interest rates trying to combat inflation by cooling consumer demand.

- During economic crises, fine wine’s performance was more stable, proving its resilience as a store of value. If we look at the worst times for other asset classes, especially during a crisis, fine wine has been resilient.

- Post-2022 correction, fine wine presents a rare entry opportunity, as historical trends show that the market rebounds strongly following periods of price adjustment. Following each market downturn cycle, fine wine has reverted to the long-term, which suggests that now is an opportune time to invest.

- The data demonstrates the counter-cyclical performance of fine wine, underlying its characteristics as an uncorrelated asset and a powerful way to diversify your portfolio.

- Over the past twenty years, wine has rarely been outside the top 2 or 3 in terms of performance, the recent overperformance of equities whilst wine has been through a sharp correction, feels an overexaggeration of the long-term trend, and suggests that this trend is likely to reverse to the long-term.

Fine Wine vs. Market Crashes

A Hedge Against Volatility

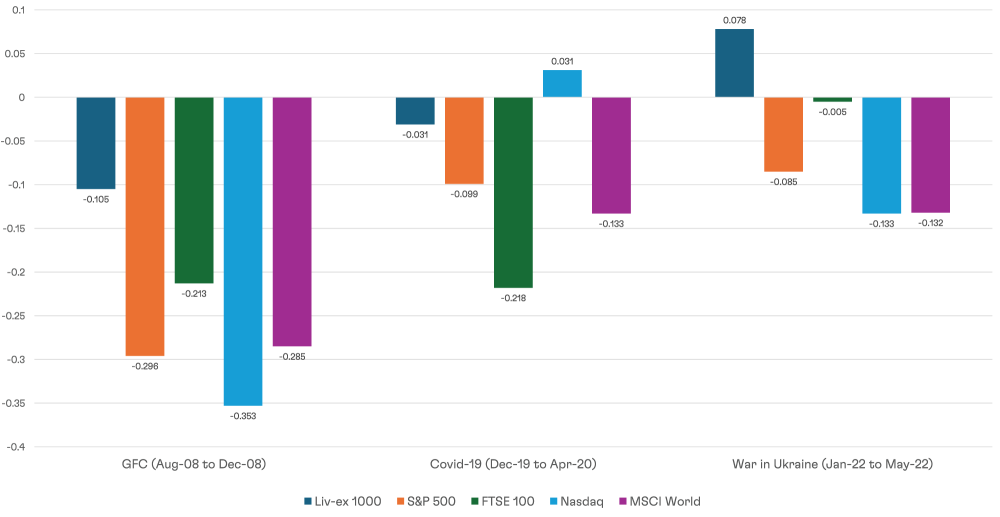

Looking at major financial downturns, fine wine’s resilience is evident:

Source: Liv-ex and investing.com.

August 2018-December 2018 / December 2019-April 2020 / January 2022-May 2022

- Global Financial Crisis (2008): Fine wine saw a moderate dip but rebounded significantly faster than equities, reinforcing its defensive characteristics.

- COVID-19 Market Shock (2020): Unlike equities, which experienced extreme volatility, fine wine was minimally impacted, showcasing its uncorrelated nature.

- War in Ukraine (2022): Major geo-political events often have a big impact on traditional financial assets. As the data shows, despite equities taking a hit in the immediate aftermath of the Russian invasion, fine wine reversed the trend, posting positive gains.

Fine Wine Investment Guide 2025

Download your guide to fine wine investing and discover how this unique, tangible, and tax-efficient asset can enhance portfolio diversification. Gain valuable knowledge and insights with this indispensable document for investors.

Volatility & Risk-Adjusted Returns

Fine Wine Outperforms

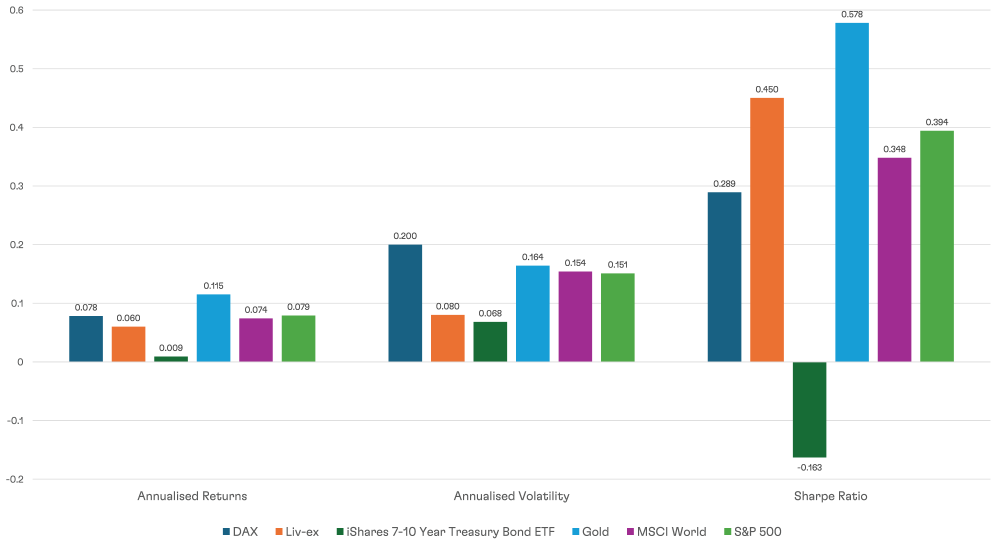

Looking at major financial downturns, fine wine’s resilience is evident:

Source: Liv-ex and investing.com. July 2004 to March 2025

- Fine wine exhibited lower volatility than equities, meaning it avoids the large fluctuations seen in stock markets.

- Fine wine’s Sharpe Ratio was competitive, proving that it delivers strong returns relative to risk.

Portfolio Optimisation

The Impact of a Fine Wine Allocation

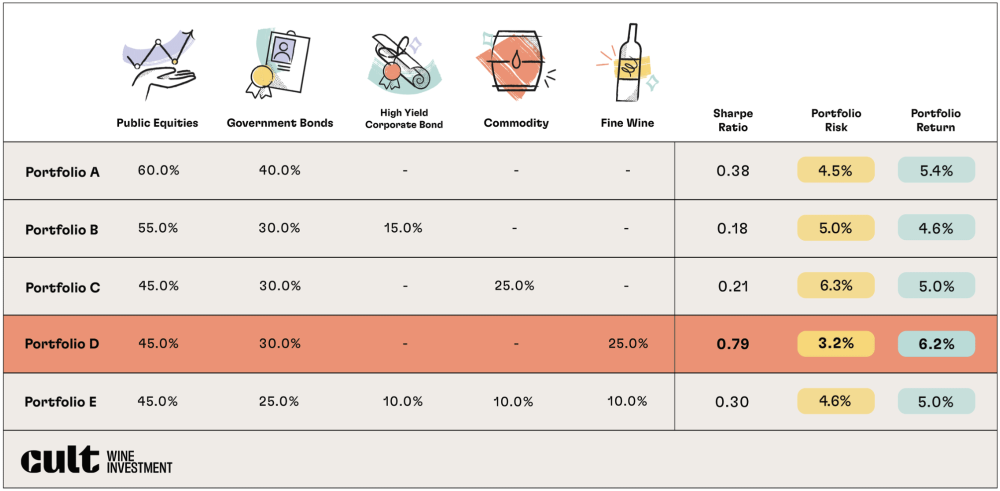

To quantify fine wine’s impact on portfolio performance, we simulated three portfolio allocations:

- Traditional 60/40 (Equities/Bonds) – Historically effective but increasingly less reliable in today’s economic landscape.

- Diversified Portfolio (Equities, Bonds, Alternatives) – Incorporating gold and fine wine, this mix reduced risk and improved stability.

- Optimised Portfolio (Fine Wine) – This allocation delivered the highest risk-adjusted returns, proving fine wine’s ability to enhance stability and long-term gains.

While allocating 25% of capital to wine may be unrealistic, it effectively illustrates the broader point - fine wine, when incorporated alongside core assets, has the potential to provide downside protection and stability and enhance overall risk-adjusted returns.

As mentioned, the recent two-year downturn has somewhat diminished wine’s positive impact from a pure return perspective. However, with equity markets appearing frothy and global economic conditions becoming increasingly unpredictable, investors are beginning to seek alternative sources of return and hedging strategies against volatility in traditional asset classes.

Investing in wine as part of a balanced investment strategy is not a binary choice - it’s not about choosing equities or alternatives but rather adopting the right approach across asset buckets. This analysis highlights that fine wine deserves a place within the alternatives allocation, reinforcing its role as a strategic diversifier in a well-structured portfolio.

Correlation Analysis

Fine Wine as a Portfolio Diversifier

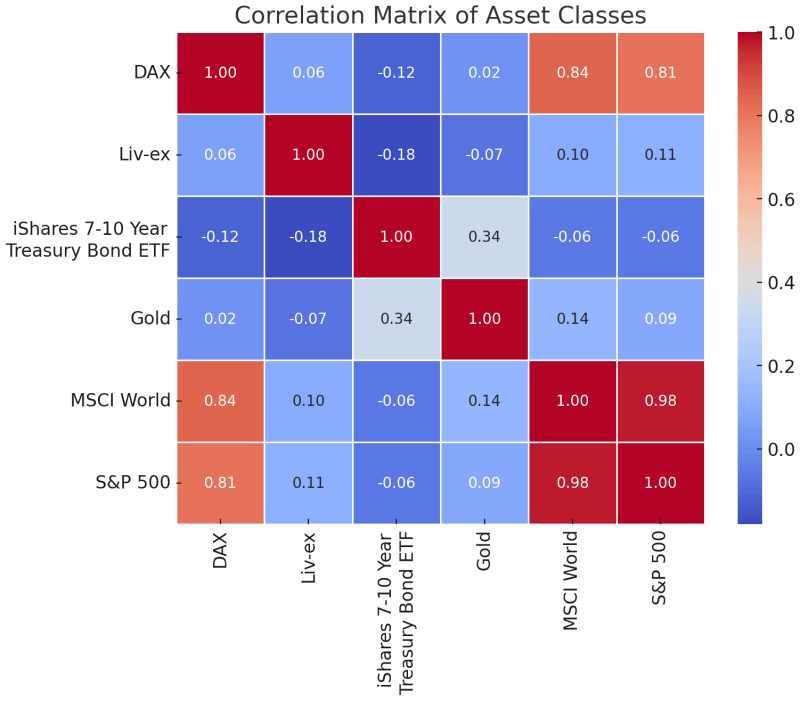

The correlation matrix demonstrates that fine wine exhibits near-zero or negative correlation with major financial assets:

- Low correlation with equities (S&P 500, MSCI World, DAX) – While equity markets are highly correlated with each other, fine wine prices move independently, reducing exposure to broad market swings.

- Negligible correlation with bonds & gold – Even during bond market volatility and inflationary periods where gold appreciates, fine wine remains largely uncorrelated, proving its unique position as an alternative asset.

Final Thoughts

Why 2025 Is the Right Time to Invest in Fine Wine

As we analysed in our previous article, top investment managers such as Goldman Sachs are recommending that investors diversify in 2025 and focus on assets that provide true, uncorrelated returns. The data is clear—fine wine is an anti-cyclical, low-correlation asset class that enhances portfolio performance while reducing risk.

Additionally, the recent short-term outperformance of financial assets, following a two-year price correction, does not reflect the long-term trend. We anticipate a reversal of this trend within the next 18–24 months due to macroeconomic conditions, and we believe that the short-term should not be mistaken for the long-term.

As market volatility remains high and investors seek uncorrelated assets, fine wine offers:

- Steady long-term appreciation

- Low correlation to traditional markets

- Proven resilience during downturns

- Attractive risk-adjusted returns

- A rare post-correction entry point

2025 presents a particularly compelling entry point into the market. Given that previous corrections have been followed by strong rebounds, enabling investors to capture outsized returns, now is an ideal time to consider fine wine as an asset class.

Find Out More

To explore how fine wine can fit into your portfolio, book a call with one of our advisors today.

Disclaimer

Past performance is not indicative of future results. Returns are calculated in GBP and results may vary depending on exchange rates.

Related Articles