The Economics of Wine Appreciation: Why Wine Investment Works

Fine wine is fundamentally different from most consumer products, which are at their peak quality the moment they are manufactured. A luxury watch, a car, or an electronic device is typically at its best on the day it leaves the factory, with value declining due to wear, obsolescence, or depreciation. Fine wine, however, follows an inverse trajectory—it is not at its best quality at the time of release. Instead, it evolves, matures, and improves with time, making ageing a key component of its perceived and financial value.

This unique characteristic is central to why fine wine works as an investment—because time itself is a critical driver of both quality and economic value. But beyond simple time-based appreciation, fine wine also exhibits characteristics of a Veblen good, where higher prices can actually drive higher demand. This interplay between time elasticity and Veblen dynamics creates a compelling investment opportunity, unlike any other asset class.

Time Elasticity

The Foundation of Wine Investment

Fine wine’s investment appeal is deeply rooted in time elasticity, the idea that consumers are willing to pay a premium to avoid the wait for a bottle to reach optimal maturity.

If a newly bottled fine wine is priced at £100 today but requires ten years of ageing to reach its peak drinking window, how much would a consumer be willing to pay to skip that ten-year wait?

At a 0% price premium, where both the new and 10-year-old bottle are priced at £100, all consumers would choose the aged bottle, assuming storage conditions were ideal. However, as the price premium for the aged bottle increases, some consumers will start opting for the younger bottle, preferring to wait rather than pay an excessive markup.

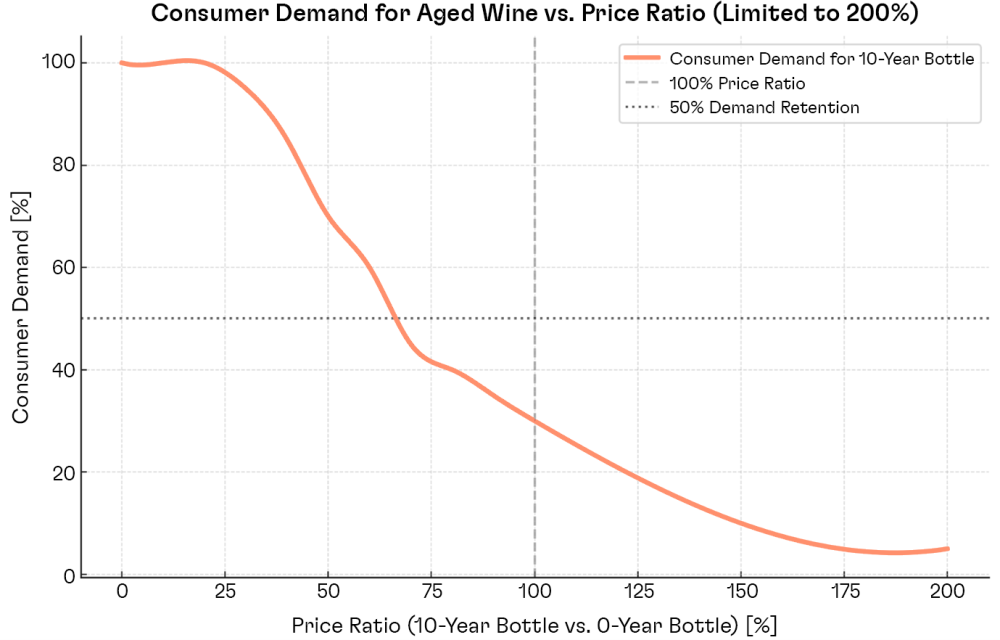

If plotted as a demand curve, we can see how consumer willingness to pay declines as the price premium increases, creating a non-linear relationship between time and price elasticity.

Visualising the Price-Time Trade-Off

Below is a graph illustrating consumer demand for a 10-year-old bottle of fine wine as its price increases relative to the original release price:

- At low price ratios (0%-50%), nearly all consumers prefer the aged bottle—meaning the time-based premium is marginal, and the value proposition remains strong.

- Between 50%-100% price premium, demand gradually declines as price elasticity takes effect—some consumers accept the markup, while others opt for the new bottle.

- Beyond a 100% premium (i.e., when the aged bottle is double the price of the new one), demand drops off significantly—only collectors or those who absolutely require immediate consumption will pay the premium.

- At extreme price ratios (500%-1000%), demand collapses—only the wealthiest buyers or those driven by status will purchase at this level.

This demonstrates that for fine wine investment to generate sustainable returns, the price premium of aged bottles must be large enough to justify the holding period but not so high that it eliminates consumer demand.

The Shift in Demand Dynamics

While the time elasticity model explains wine appreciation in a rational way, certain wines defy traditional price-demand relationships. This is where Veblen dynamics come into play.

A Veblen good is a product where demand increases as price rises rather than falling. Luxury brands like Rolex, Hermès, and Ferrari exemplify this, where exclusivity and high price points signal status, rarity, and desirability.

Fine wine exhibits similar Veblen tendencies—especially at the highest levels of the market. Once a wine reaches a certain threshold of prestige and scarcity, its price stops being a function of time elasticity and instead becomes a function of status-driven demand.

This explains why:

- A well-aged Bordeaux classified growth may appreciate at a steady 7% annualised rate—following the rational price-time elasticity model.

- A bottle of Domaine de la Romanée-Conti (DRC), Screaming Eagle, or Château Lafite Rothschild can see exponential price growth beyond traditional time-value economics as collectors, high-net-worth buyers, and prestige-driven consumers bid up prices far beyond intrinsic drinking value.

Spotlight Examples

Here are four standout examples of wines that have transcended time-based appreciation and become status-driven luxury assets:

Sassicaia 1985

The Birth of a Mythical Vintage

Price Today: ~£3,000 per bottle

Recent Vintages: ~£200-£250 per bottle

The 1985 Sassicaia holds a special place in wine history. It was the first Italian wine to receive a perfect 100-point score from Robert Parker, elevating it to legendary status. While Sassicaia continues to produce excellent wines, no other vintage commands anywhere near the same premium.

The price disparity isn’t about objective quality alone. It’s about mythology, collectability, and prestige. Investors and collectors seek it not just to drink but to own a piece of wine history, making it one of the best examples of Veblen demand in the fine wine market.

Château Lafite Rothschild 1982

The Wine That Defined a Market

Price Today: ~£2,500 per bottle

Recent Vintages: ~£400 per bottle

The 1982 Lafite Rothschild is arguably the most culturally significant vintage in Asia. This was the wine that ignited China’s luxury wine boom, referenced in films, media, and high-society circles. While Lafite has produced higher-scoring vintages, none have achieved the same cultural cachet.

This is a perfect case where perception outweighs intrinsic value. The 1982 commands a 6x premium over newer vintages, not because it is that much better, but because it is an icon of wealth, status, and power in Asian markets.

DRC Romanée-Conti 1945

The Ultimate Prestige Wine

World Record Auction Price: $558,000 per bottle

Recent Vintages: ~£200-£15,000 per bottle

Few wines embody Veblen dynamics more than Domaine de la Romanée-Conti (DRC), and the 1945 vintage is the pinnacle of luxury wine collecting. Sold for over half a million dollars per bottle, this wine is the ultimate fusion of prestige, rarity, and historical significance.

- Production was minuscule—just 600 bottles were made, marking the final vintage before the old vines were replanted.

- It is an artifact of history—1945 represents the end of WWII, a rebirth for France, and a turning point for fine wine.

- It is a collector’s dream—unlike younger DRC vintages, which trade at ~£15,000 per bottle, the 1945 is a cultural and historical relic, making it a prime example of prestige pricing in wine.

At this level, price is not about drinking—it’s about owning a piece of history.

Château Mouton Rothschild 2000

When Packaging Drives Price

Price Today: ~£1,500 per bottle

Recent Vintages: ~£350 per bottle

Unlike the other examples, Mouton 2000 is not the estate’s best vintage. It is a high-quality wine but not considered one of Mouton’s all-time greats. Yet, for over two decades, it has consistently been among the most expensive vintages of Mouton Rothschild.

Why? The gold-engraved bottle design.

Mouton 2000 was released in a special gold-enamel bottle, making it an instant collector’s piece. Unlike other vintages, where price appreciation is driven by age-ability and scarcity, here, the primary factor is visual and cultural appeal.

This wine stretches the traditional age-ability argument. Demand for Mouton 2000 does not diminish even at significant price multiples, proving that in the fine wine world, aesthetic, perception and brand power can override traditional economic logic.

What These Wines Teach Us About Fine Wine Investment

Each of these wines has defied traditional price-demand curves and entered the world of Veblen pricing, where:

- Brand power and historical significance outweigh fundamental quality.

- Price increases reinforce desirability instead of limiting demand.

- Collectors and high-net-worth buyers drive appreciation beyond rational valuation models.

At a certain point, fine wine ceases to be a product and becomes a luxury asset, with appreciation driven less by quality or ageing and more by exclusivity, cultural cachet, and billionaire demand.

The Investor’s Sweet Spot

To maximise returns, wine investors need to identify the point at which a wine transitions from time-based appreciation to Veblen-driven price acceleration.

- Wines that are too young or from unproven producers rely on the time-value model—their price increases steadily but is ultimately capped by consumer demand elasticity.

- Wines that are blue-chip, scarce, and culturally significant can transition into a Veblen trajectory, where price appreciation accelerates due to status-driven demand rather than fundamental supply constraints.

This distinction is critical for investors—understanding when a wine will follow the economic logic of time appreciation versus when it will enter the realm of luxury asset hyper-appreciation can be the difference between a 7% annualised return and a 30% annualised return.

Why This Matters for Wine Investment in 2025

With global markets facing uncertainty, investors are actively seeking uncorrelated alternative assets. Fine wine, with its dual appreciation mechanisms (time elasticity & Veblen demand), offers a compelling case as both a stable long-term store of value and an asset with upside potential from prestige-based demand.

- For traditional investors, fine wine offers steady, low-volatility appreciation—leveraging time-value economics.

- For speculative investors, the right wines can enter Veblen pricing dynamics, unlocking outsized returns through status-driven demand.

Platforms like Cult Wine Investment and CultX enable investors to capitalise on both models, offering data-driven insights into when a wine is undervalued relative to its time-elasticity model and when a wine has the potential to transition into a Veblen pricing trajectory.

The Dual Investment Narrative of Fine Wine

Unlike other asset classes, fine wine operates under two distinct economic principles:

- Time Elasticity – Wines appreciate as they age because consumers value time, creating a predictable price appreciation curve.

- Veblen Dynamics – Prestige wines enter a luxury status cycle, where price appreciation is fuelled by exclusivity, brand power, and collector demand.

The best fine wine investments are those that start within the time-value model but transition into Veblen-driven appreciation, offering both stability and asymmetric upside.

In an investment world searching for alternative, uncorrelated, and high-return assets, fine wine stands out as an asset that leverages both time and status as economic drivers—a rare combination that few other asset classes can match.

*To learn more about our sister platform, CultX, please click here. CultX is the ultimate marketplace for buying, selling, collecting, and investing in fine wine. To explore other enticing offers currently available on CultX, please click here.

Once purchased on CultX, cases can be traded on the platform, held individually or as part of a larger portfolio, or transferred to Cult Wine Investment.

Related Articles