Bordeaux En Primeur 2024 Vintage: A Detailed Analysis

Ahead of the Bordeaux 2024 campaign, we have undertaken a price analysis to evaluate the upcoming releases.

Given the macroeconomic backdrop, the current ‘soft’ state of the fine wine market, headwinds from US tariffs and the Chinese economic slowdown, and a two-year price correction across much of the fine wine sector, the 2024 vintage is being released at an unprecedented moment for the market.

The vintages that most closely resemble the current market conditions include the 2008 En Primeur campaign, launched during the global financial crisis; the 2013 vintage, qualitatively one of the weakest in recent memory, released amid the fallout of China’s anti-corruption crackdown; the 2014 vintage, shaped by the commercial failure of 2013 and a still-lagging market; and the 2019 vintage, which was released mere months after the onset of the Covid-19 pandemic.

This year’s vintage needs to be a success for the Place de Bordeaux and the fine wine market as a whole. A strong campaign can inject significant liquidity into the system and serve as a much-needed catalyst, re-engaging consumers and breathing life back into a platform that has, in recent years, lost its allure. As such, we fully anticipate that this campaign will be driven by price (not hyperbole or critic scores), and many in the trade believe the only viable price point will be one that is genuinely attractive to consumers. It must be the cheapest available vintage on the market to stand a chance.

Recent vintages such as 2021 and 2023 are still widely available at significant discounts to their original release prices. In many cases, these represent better quality and more compelling value. If Bordeaux attempts to price the 2024 vintage above these widely available, well-discounted wines, it risks falling flat. Significant unsold volume from vintages such as 2017 remains, compounding the challenge. Wines that have already been repriced by the secondary market may be seen as more desirable purchases than similarly or higher-priced 2024.

Methodology: Defining Fair Value for 2024 Releases

To inform our analysis, we undertook the following steps:

- We collected the current in-bond per bottle price for all vintages of each wine.

- We calculated the minimum, maximum, and median prices.

- Based on the lowest-priced vintage currently available, we estimated the ideal ex-London release price for the 2024 vintage, assuming a 10% discount. For example, if the lowest-priced vintage is £100 per bottle, our target 2024 price is £100 x 12 = £1,200 x 0.90 = £1,080 per case.

- Using this target ex-London offer price, we then calculated the required ex-négociant release price in euros.

- Finally, we compared this target ex-négociant release price to the 2023 release price to calculate the discount required year-on-year.

This gives us a target percentage discount per wine, indicating the reduction needed to ensure the 2024 vintage is released at a price 10% cheaper than any other available vintage, a level we believe would offer strong commercial appeal.

Note: Current in-bond per-bottle pricing was sourced from Wine-Searcher listings by reputable UK merchants, accurate as of 31st March 2024.

Download the Bordeaux EP 2024 Price Analysis Data

Access detailed pricing insights across over 270 leading châteaux, including target ex-London release prices, vintage benchmarks, and required discount levels versus 2023.

A must-have reference for fine wine investors and trade buyers.

Summary of Results: Discounts Are Essential

Our findings indicate that for the vast majority of classified growths, substantial double-digit discounts (from 2023 release levels, in euros) will be needed for the 2024 campaign to be competitive.

| Target EP Discount | # of Wines | Total |

|---|---|---|

| <10% | 18 | 18 |

| 10–20% | 31 | 49 |

| 20–30% | 50 | 99 |

| 30–40% | 40 | 139 |

| 40–50% | 19 | 158 |

| 50%+ | 18 | 176 |

The data is striking, as fewer than 50 wines would meet our target if the discount is capped at 20%. At the 30% level, however, nearly 100 wines qualify, many of them well-known names.

| Target EP Discount | # of Wines | Highlights Include |

|---|---|---|

| <10% | 18 | Kirwan, Prieuré-Lichine, Clerc Milon |

| 10–20% | 31 | Lafite, Mouton, Lynch-Bages, Beychevelle, Talbot, Carruades, Petit Mouton, Gloria, Gazin |

| 20–30% | 50 | Haut-Brion, Margaux, Pichon Baron, Clos Fourtet, Ducru, Léoville Poyferré, Langoa Barton, d’Armailhac, Pavie Macquin, Calon Ségur, Pichon Lalande, Léoville Las Cases, Angélus |

| 30–40% | 40 | Cheval Blanc, Ausone, Pontet-Canet, Beau-Séjour Bécot, Cos d’Estournel, La Mission Haut-Brion, Les Carmes Haut-Brion, Clinet, Léoville Barton, Duhart-Milon, Rauzan-Ségla |

| 40–50% | 19 | Grand-Puy-Lacoste, Figeac, Smith Haut Lafitte, Pavie, Palmer, L’Évangile |

| 50%+ | 18 | Montrose, Canon, La Conseillante, Vieux Château Certan, Haut-Bailly, L’Église-Clinet |

A 30% discount would make the 2024 campaign significantly more attractive, offering both négociants and buyers a wide range of opportunities, with almost 100 wines available at a 10% or greater discount compared to any other vintage.

Of course, not all wines will be able to meet the threshold. In some cases, such as Canon, the lowest-priced vintage in bond is the 2013 at £42 per bottle, but today, Canon is considered one of the most sought-after wines of any vintage. Comparing today’s Canon to its pre-2010 versions is no longer meaningful. So, while the 2024 release may not be the cheapest on the market, a substantial discount on the 2023 release price (e.g. 80 euros) could still present a compelling opportunity for collectors.

The data makes one thing clear: most if not all, châteaux will need to offer meaningful price reductions if they want to attract demand. The market needs it. Early reports suggest this message may have landed, but history tells us that meaningful reductions don’t always materialise.

Furthermore, with the nature of the Bordeaux distribution model, there is a risk that strong wines are overshadowed by a broader field of overpriced releases. Merchants often face pressure to take a range of wines to secure allocations of the best. This hurts margins and diminishes the impact of the well-priced wines.

What this campaign needs is breadth, many wines priced attractively, not just a few cherries. That would enable merchants and négociants to offer true flexibility and create a rising tide that benefits all participants in the system.

Analysis by Category

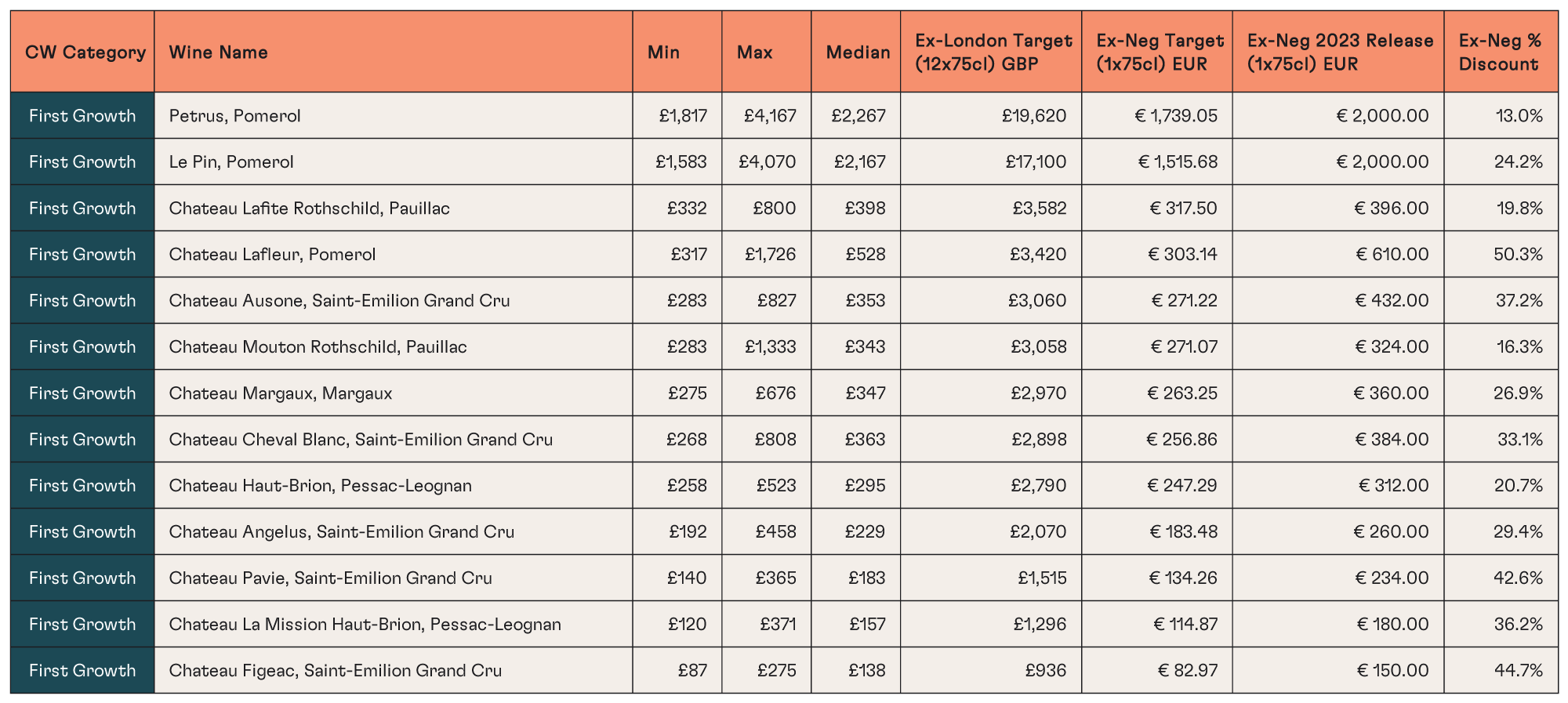

First Growths

(This includes the four Left Bank first growths, plus La Mission Haut-Brion, as well as top-tier Right Bank wines like Le Pin and Petrus.)

Encouragingly, a 30% discount would make the Left Bank first growths cheaper than any other vintage on the market. The same applies to Pomerol icons like Le Pin and Petrus. The challenge lies more with certain Premier Grand Cru Classés of Saint-Émilion, where significant price gaps remain between pre- and post-reclassification vintages. That said, discounts against recent vintages (2017, 2021, 2023) would be enough to reignite interest. The outlook for this category is cautiously optimistic.

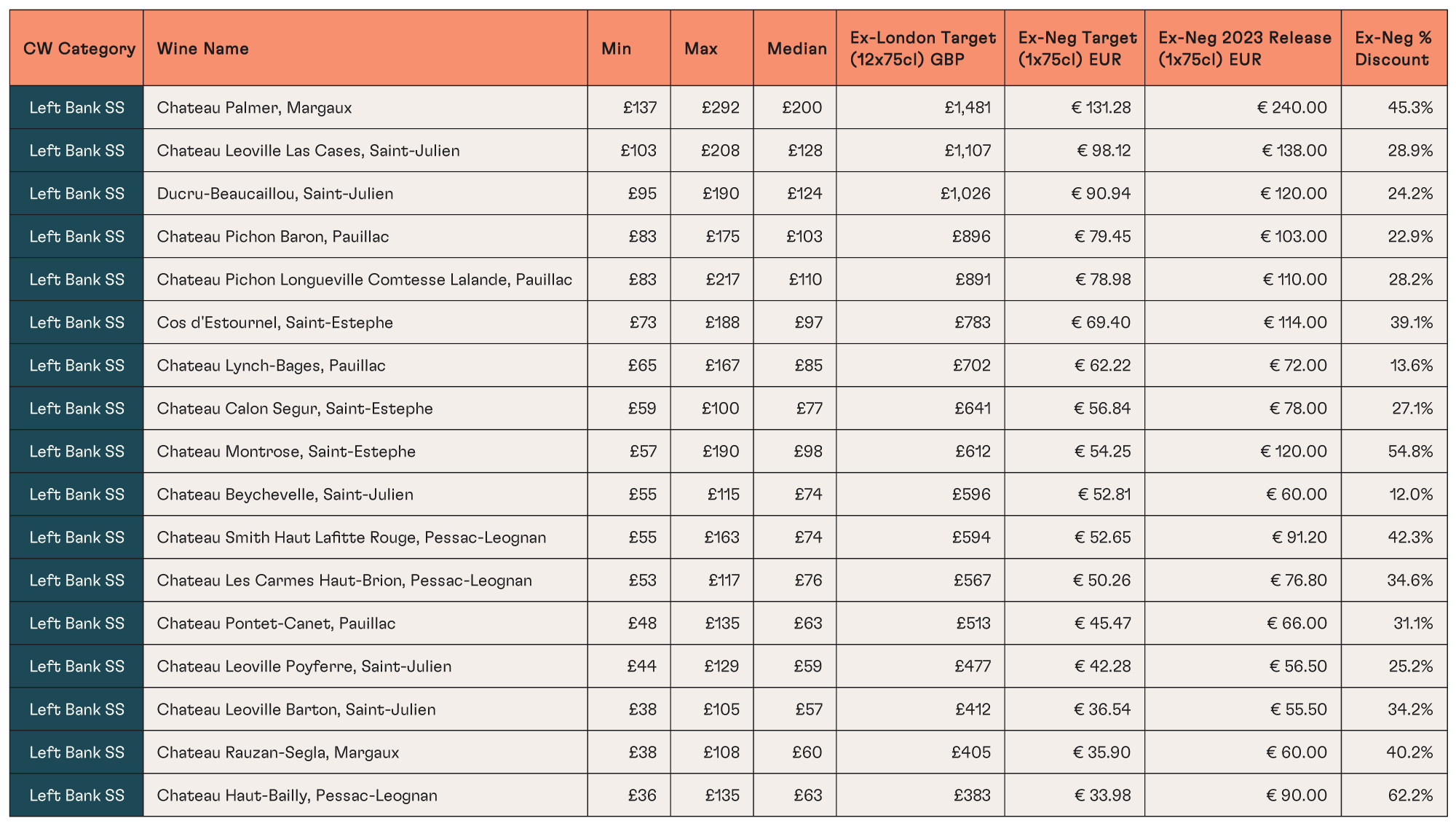

Left Bank Super Seconds

(High-profile classified growths from the Left Bank, including those outside the second growth classification.)

At a 30% discount, around half of the wines analysed would be priced 10% below any available vintage. That list includes major names, Lynch-Bages, Beychevelle, Ducru, Pichon Lalande, and Léoville Las Cases. These are among the most liquid wines globally, with strong brand equity and high production volumes. Releases at the right price are likely to perform well, particularly given how off-vintages in this category often outperform due to more attractive pricing. Pontet-Canet’s 2024 release (expected 23rd April) will be an early bellwether. With the 2021 vintage trading at £48/bottle in bond, a £513 case price (£42.75/bottle) could be a compelling hook for buyers.

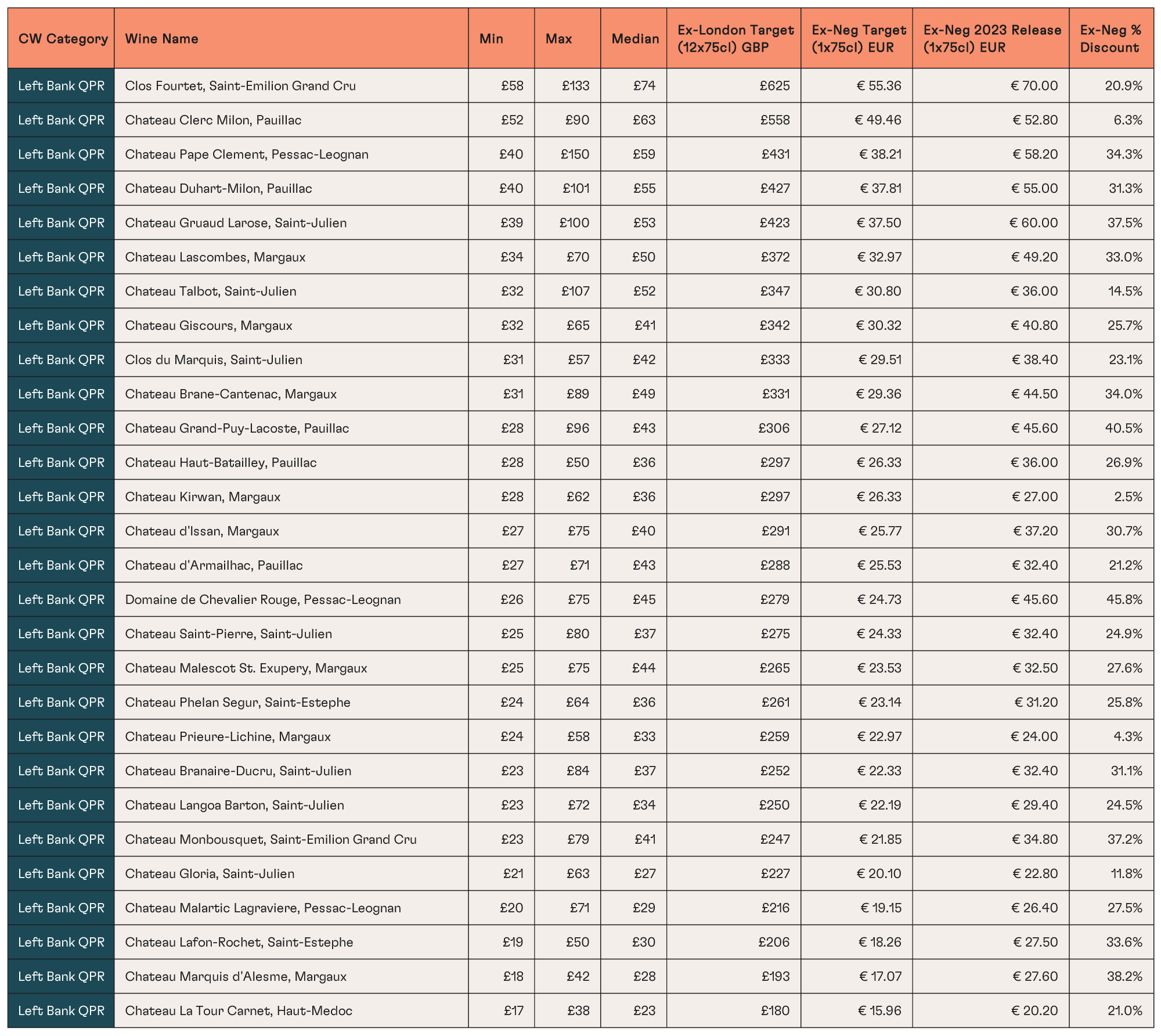

Left Bank QPR

(Classified growths on the Left Bank offering strong value in quality-to-price terms.)

This category has offered Bordeaux buyers strong value in recent years, though performance has lagged. In 2023, the average release price was 37.1 euros per bottle. For 2024 to resonate, we estimate the average would need to fall to 27 euros (£300/case or £25/bottle). Regardless of critic scores, that price point offers compelling value. A 30% discount would make 16 wines stand out, including Clerc Milon, Talbot, and Langoa Barton. For many in this category, though, achieving these prices may be more challenging. They’re already priced lower, so cuts of this magnitude may be hard to justify economically.

Download the Bordeaux EP 2024 Price Analysis Data

Access detailed pricing insights across over 270 leading châteaux, including target ex-London release prices, vintage benchmarks, and required discount levels versus 2023.

A must-have reference for fine wine investors and trade buyers.

Conclusion: Can Bordeaux Meet the Moment?

The Bordeaux 2024 En Primeur campaign stands at a crossroads.

The data is clear: for this campaign to succeed, price will need to lead the conversation. Substantial discounts, particularly in the 30%+ range, are not only justified by market context but are required to compete with available back vintages and re-engage a cautious buyer base.

Encouragingly, our analysis shows that if producers rise to the challenge, there is a real opportunity to reinvigorate confidence in the system. A campaign driven by breadth, realism, and value, rather than selective hype, could breathe life back into En Primeur and provide much-needed liquidity across the trade.

Given parallels 2024 can draw with 2008, 2013, 2014 and 2019, history shows that when priced attractively, these vintages can deliver value to buyers. It’s now a question of whether the châteaux are ready to meet the moment.