Is the Wine Market Poised for Growth? The Impact of Upcoming Interest Rate Cuts

As global economic conditions shift, investors are increasingly turning to alternative assets like fine wine to diversify their portfolios. But what role do interest rates play in this burgeoning market? With central banks around the world poised to lower interest rates further, the potential impact on the wine market is a topic of growing interest.

In this article, we examine the intricate relationship between the Wine Index and interest rates over time, explore how this dynamic has evolved since 2021, and provide a forward-looking analysis of what these trends might mean for the future of wine investments. Whether you're a seasoned investor or new to the world of fine wine, understanding these connections could help you navigate the market with greater confidence.

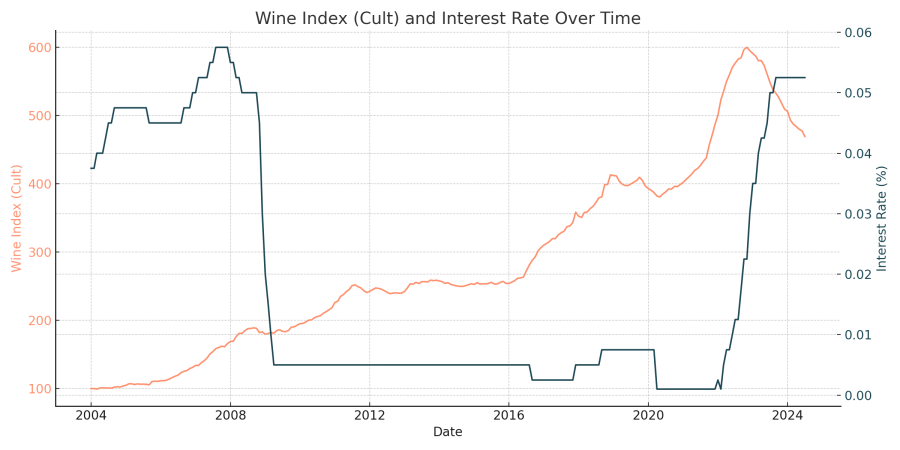

Tracing the trends: Analysing the relationship between Wine Index and interest rates over time

The year-by-year analysis of the correlation between the Wine Index (Cult) and Interest Rate (%) reveals some interesting patterns and fluctuations:

![]() Positive correlation years (2004, 2006, 2007, 2017, 2018, 2021, 2022):

Positive correlation years (2004, 2006, 2007, 2017, 2018, 2021, 2022):

-

- In these years, a positive correlation was observed, indicating that both the Wine Index and Interest Rates tended to move in the same direction. For example, in 2006, 2007, and 2018, the correlation was particularly strong, with values above 0.85.

- This suggests that during these periods, the market dynamics influencing both wine investments and interest rates were possibly aligned, perhaps driven by general economic optimism or other common external factors.

- In these years, a positive correlation was observed, indicating that both the Wine Index and Interest Rates tended to move in the same direction. For example, in 2006, 2007, and 2018, the correlation was particularly strong, with values above 0.85.

![]() Negative correlation years (2005, 2009, 2016, 2020, 2023):

Negative correlation years (2005, 2009, 2016, 2020, 2023):

-

- In years like 2005, 2009, 2016, and notably 2023, a negative correlation was observed. This indicates that when interest rates rose, the Wine Index tended to fall, and vice versa.

- The strongest negative correlation was observed in 2023 (-0.93) and 2016 (-0.90), suggesting a more pronounced inverse relationship during those years. This could be reflective of economic environments where rising interest rates led to reduced investment in non-traditional assets like wine, as investors might have shifted to more traditional financial instruments.

- In years like 2005, 2009, 2016, and notably 2023, a negative correlation was observed. This indicates that when interest rates rose, the Wine Index tended to fall, and vice versa.

![]() Low or near-zero correlation (2008, 2020):

Low or near-zero correlation (2008, 2020):

-

- Years like 2008 and 2020 show a near-zero correlation, indicating little to no linear relationship between the two variables. These periods may have been marked by economic uncertainties or shocks (e.g., the global financial crisis in 2008 or the COVID-19 pandemic in 2020), where the usual market relationships were disrupted.

The correlation between the Wine Index (Cult) and Interest Rate (%) fluctuates significantly over time, suggesting that the relationship between these two variables is not consistent and can be heavily influenced by external economic factors. During certain periods, they move together, while in others, they move inversely or have no apparent relationship at all.

- Market dynamics: The wine market, like other luxury and alternative investments, can be sensitive to broader economic conditions. When interest rates are low, investors may seek out alternative investments like fine wine, leading to a positive correlation. Conversely, when rates rise, traditional investments may become more attractive, leading to a negative correlation.

- Economic shocks: Events like the 2008 financial crisis and the 2020 pandemic seem to disrupt the usual market relationships, leading to weaker or zero correlations.

Overall, the relationship between interest rates and wine index values appears to be complex and influenced by broader economic conditions, investor behaviour, and market sentiment.

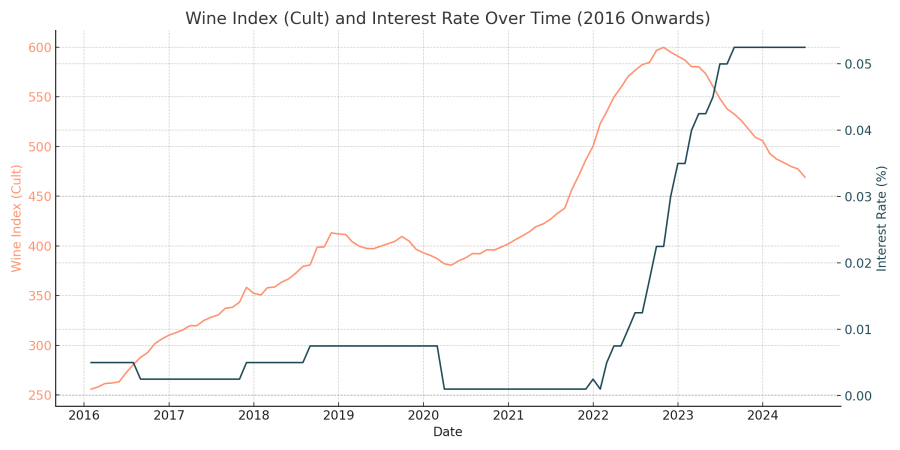

Interest rates and fine wine more highly correlated since 2021

From 2021 onwards, the correlation between Wine Index returns and Interest Rates is approximately -0.856. This strong negative correlation suggests a closer and more direct relationship between the two variables during this period. Specifically, as interest rates increased, the returns on the Wine Index tended to decrease, and vice versa.

Interpretation of the correlation (2021 onwards)

- Closer relationship: The data indicates that starting from 2021, the relationship between interest rates and wine index returns has become more pronounced. The strong negative correlation implies that changes in interest rates are more closely tied to movements in the wine index returns.

- Economic context: This period coincides with significant economic shifts, including global inflationary pressures and central banks' responses to interest rate hikes. Investors might have reacted strongly to these changes, moving away from or towards alternative assets like wine, depending on interest rate trends.

Potential time lag analysis

To analyse whether there is a time lag between interest rate changes and their impact on wine index returns, we can look at lagged correlations. A time lag would mean that changes in interest rates might not immediately impact wine index returns but could have a delayed effect.

The lagged correlations between Wine Index returns and Interest Rates from 2021 onwards are as follows:

- 1-month lag: correlation = -0.850

- 2-month lag: correlation = -0.854

- 3-month lag: correlation = -0.838

Analysis and interpretation

- Minimal time lag impact: The correlations are quite similar across the different lags, indicating that the impact of interest rate changes on wine index returns occurs fairly quickly, within 1-2 months. There isn't a significant increase in correlation with longer lags, suggesting that the relationship between interest rates and wine index returns is relatively immediate.

- Strong negative correlation: The consistently strong negative correlation across these lags further reinforces the idea that from 2021 onwards, rising interest rates have had a quick and adverse effect on wine index returns. Conversely, any cuts in interest rates are likely to have a positive and fairly immediate impact on wine returns.

The data from 2021 onwards shows a close and relatively immediate relationship between interest rates and wine index returns, with no significant time lag. This suggests that investors in the wine market have been reacting promptly to changes in interest rates, possibly reflecting a heightened sensitivity to economic conditions during this period.

Given the current economic outlook and anticipated interest rate cuts, we could expect that any reductions in rates might quickly lead to improved returns in the wine market. However, the strong negative correlation also means that if rates were to rise unexpectedly, the wine market could experience rapid declines.

Fine Wine Investment Guide 2025

Download your guide to fine wine investing and discover how this unique, tangible, and tax-efficient asset can enhance portfolio diversification. Gain valuable knowledge and insights with this indispensable document for investors.

Outlook on the wine market based on interest rate changes

Given the recent trends and the historical data, the anticipated interest rate cuts by major central banks (including the Bank of England, the Eurozone, and potentially the US Federal Reserve) suggest a few key implications for the wine market:

![]() Potential for increased investment in alternative assets

Potential for increased investment in alternative assets

-

- Historical correlation: In periods where interest rates have been cut or remained low, we have observed positive correlations between the Wine Index and interest rates. This suggests that lower interest rates often lead to increased investment in alternative assets like fine wine. Investors seeking higher returns than those available from traditional low-yield bonds or savings accounts may turn to the wine market.

- Current economic context: With central banks lowering rates and potentially doing so further, capital that would typically flow into bonds or savings could be redirected into alternative investments. The wine market, with its reputation as a stable, non-correlated asset, could see increased demand, pushing the Wine Index higher.

- Historical correlation: In periods where interest rates have been cut or remained low, we have observed positive correlations between the Wine Index and interest rates. This suggests that lower interest rates often lead to increased investment in alternative assets like fine wine. Investors seeking higher returns than those available from traditional low-yield bonds or savings accounts may turn to the wine market.

![]() Economic uncertainty could drive mixed results

Economic uncertainty could drive mixed results

-

- Weak economic data: The weak economic data from the US and other regions introduces a layer of uncertainty. If the economic outlook remains unclear or deteriorates, even with lower interest rates, the market for luxury or non-essential goods (including fine wine) could face headwinds. In times of uncertainty, investors may still prefer liquidity and safer assets over alternatives like wine.

- Divergent correlation patterns: Historical data shows that during periods of economic shocks or uncertainty (e.g., 2008, 2020), the correlation between interest rates and wine investments can weaken or even reverse. This suggests that while lower rates are generally supportive of the wine market, the overall economic environment will play a crucial role.

- Weak economic data: The weak economic data from the US and other regions introduces a layer of uncertainty. If the economic outlook remains unclear or deteriorates, even with lower interest rates, the market for luxury or non-essential goods (including fine wine) could face headwinds. In times of uncertainty, investors may still prefer liquidity and safer assets over alternatives like wine.

![]() Wine market outlook and forecast

Wine market outlook and forecast

-

- Short-term (next 6-12 months): If the Fed and other central banks follow through with interest rate cuts, we could see a favourable environment for the wine market. The combination of lower interest rates and the search for yield in alternative investments could push the Wine Index higher. I would expect a moderate increase in the Wine Index over the next 6-12 months, particularly if economic conditions stabilise or improve slightly.

- Medium-term (1-2 years): Beyond the immediate term, the outlook will depend on the broader economic recovery and investor sentiment. If the global economy begins to recover and confidence returns, we could see continued growth in the wine market as investors diversify into alternative assets. However, if economic weakness persists or worsens, the demand for fine wine could stagnate, leading to a flatter growth trajectory for the Wine Index.

- Short-term (next 6-12 months): If the Fed and other central banks follow through with interest rate cuts, we could see a favourable environment for the wine market. The combination of lower interest rates and the search for yield in alternative investments could push the Wine Index higher. I would expect a moderate increase in the Wine Index over the next 6-12 months, particularly if economic conditions stabilise or improve slightly.

Risks to consider

- Inflationary pressures: If inflation remains high despite rate cuts, central banks might reverse course, leading to higher rates and a potential outflow from alternative investments.

- Global economic conditions: The wine market is international, and economic conditions in key markets (e.g., China, Europe, and the US) will impact demand. Economic weakness in these regions could dampen the positive effects of lower rates.

Given the anticipated rate cuts and historical data, I would forecast a cautiously optimistic outlook for the wine market. The Wine Index is likely to see moderate gains as investors seek alternatives in a low-interest-rate environment.

However, this is contingent on the absence of significant economic shocks and a gradual stabilisation of global economic conditions. Investors in the wine market should remain attentive to broader economic indicators and be prepared for potential volatility in the short term.

Related Articles